US Dollar on the Rise: Stronger Bond Yields, Europe Lockdowns Support

The US dollar is continuing to maintain its strength, trading close to the highest levels seen in several months against most of its key

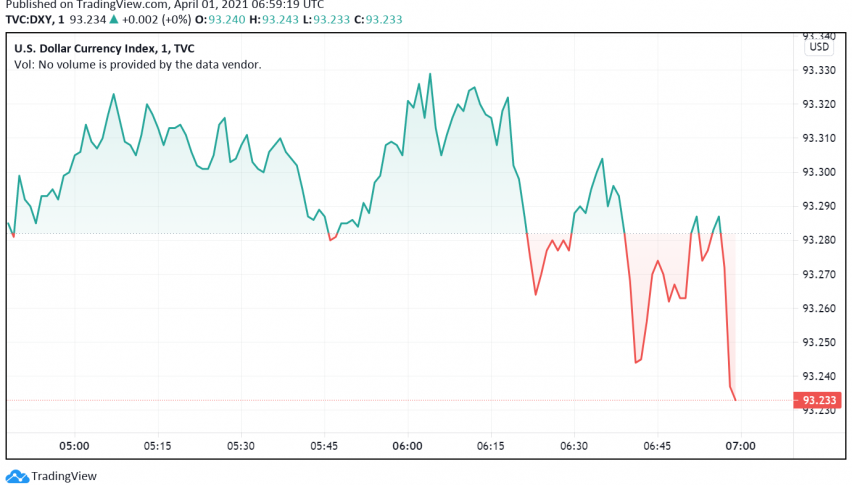

The US dollar is continuing to maintain its strength, trading close to the highest levels seen in several months against most of its key rivals amid rising hopes for rapid economic recovery in the US, fueled by COVID-19 vaccine rollouts and multiple rounds of fiscal stimulus. At the time of writing, the US dollar index DXY is trading around 93.23.

The dollar index touched the highest level seen in five months during the previous session, but has eased lower since then. One of the biggest drivers of this strength remains the bearish outlook in the Euro as markets worry about the economic impact of the latest wave of infections and lockdowns affecting most parts of Europe.

France went into its third nationwide lockdown to combat the latest wave of the pandemic even as the EU region as a whole has been slower with its COVID-19 vaccine distribution program, especially in comparison with the UK and the US. In addition, the US dollar has also been strengthening against the safe haven Japanese yen due to a spike in US bond yields.

Closely following the release of the latest COVID-19 relief package, President Joe Biden laid out his job plan valued at over $2 trillion, which includes $621 billion of spending to improve US’s infrastructure. The additional spending is likely to further spur economic recovery in the US, supporting the bullish trend in the greenback.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account