$55,000 Is Back In Play For Bitcoin (BTC)

Institutional adoption and the Taproot upgrade point to bullish Bitcoin prices coming in the weeks and months ahead.

It has been a turbulent day on the crypto markets as whipsaw action has been the rule. At the midway point of the U.S. trading day, Bitcoin BTC (-2.47%), Ethereum ETH (-5.25%), Litecoin LTC (-8.82%), and XRP (-3.38%) have all rebounded from steep sell-offs.

As always, the action in crypto is driven by a bit of rumor, fact, and obscure technology. Accordingly, these stories may have had something to do with today’s turbulence:

- Jamie Dimon: JP Morgan head Jamie Dimon issued a letter to shareholders stating that the regulatory status of cryptocurrencies is a “serious emerging issue that needs to be dealt with.” This follows JP Morgan’s $130,000 topside target for Bitcoin issued last week. So, will Dimon and JP Morgan enter the cryptosphere if more regulation is enacted? With such a bullish estimate for BTC, it’s hard to imagine that they will stay out.

- Taproot: The final strokes have been put on Bitcoin’s Taproot upgrade. Programmers have decided that median time passed (MTP) will be used for Taproot’s activation timeline. At this point, estimates suggest that Taproot will be fully integrated in November.

Ultimately, these two news items point to a bullish BTC over the intermediate term. Given a much-needed system upgrade, as well as more institutional adoption, Bitcoin is positioned to at least hold 2021’s gains for the near future.

Bitcoin Pulls Back, $55,000 In Play

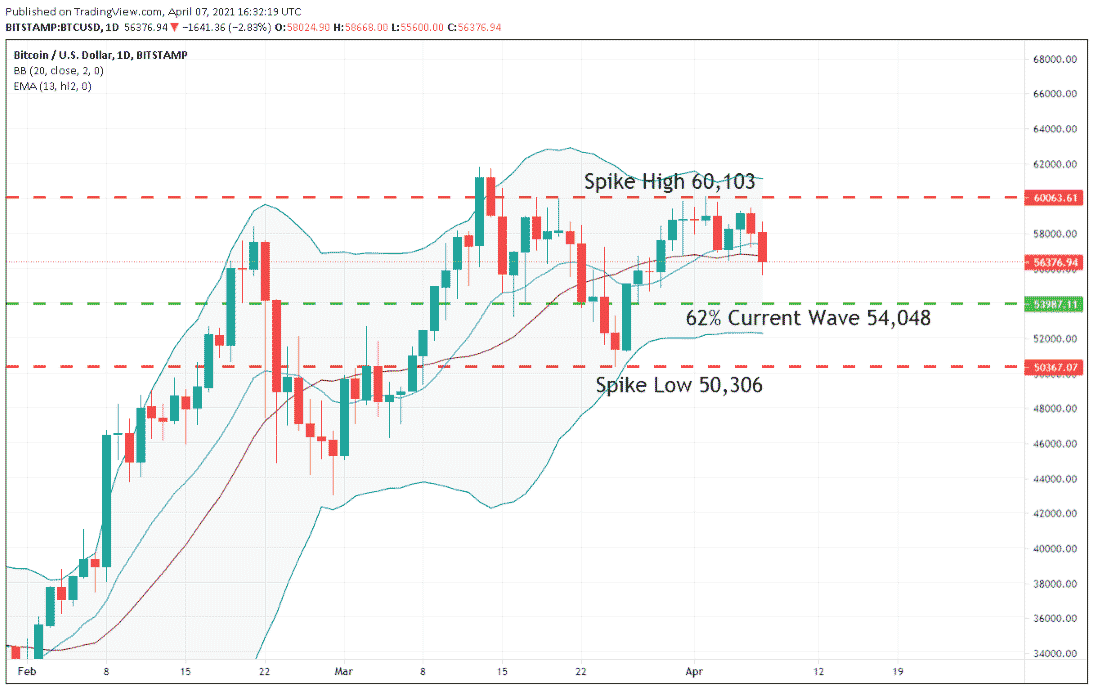

The daily Bitcoin chart below gives us a good look at where BTC stands. Prices are in the midst of a two-day slide but are holding above $55,000.

Here’s one level to watch until Friday’s closing bell:

- Support(1): 62% Current Wave Retracement, $54,048

Bottom Line: If BTC continues to pull back, a buying opportunity may come into play. Until elected, I’ll be looking to buy Bitcoin from $54,075. With an initial stop loss at $51,075, this trade returns 5.5% ($3000) on a standard 1:1 risk vs reward ratio.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account