US Dollar Holds Close to Multi-month Lows – Fed to Remain Dovish Longer

The US dollar continues to languish close to recent lows early on Friday, set to end this week in the red amid concerns about the Fed

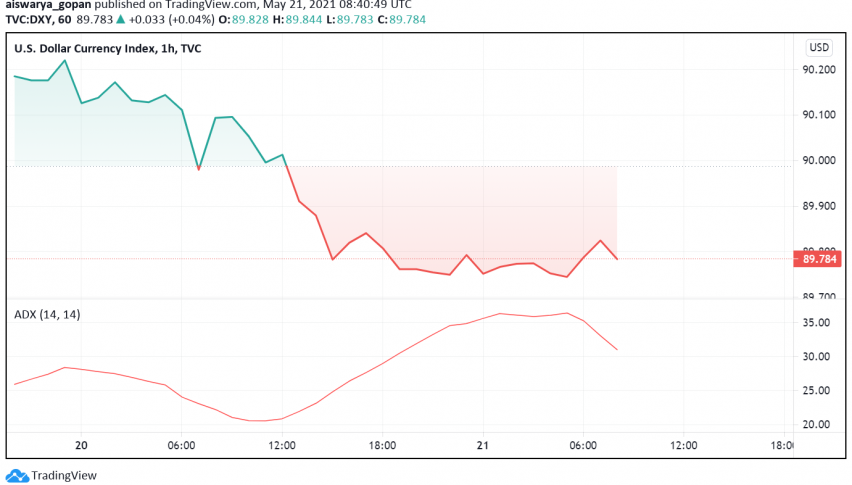

The US dollar continues to languish close to recent lows early on Friday, set to end this week in the red amid concerns about the Fed maintaining its dovish outlook for longer despite the US economy recovering rapidly from the coronavirus crisis. At the time of writing, the US dollar index DXY is trading around 89.78.

The latest Fed meeting’s minutes which released on Wednesday offered some respite to the bearish trend after they indicated increased interest among policymakers to talk about tapering off bond purchases as the economic recovery gathers strength. However, the upbeat mood was short-lived as Fed officials continued to play down any plans to reverse their plans to extend support to the economy until employment and inflation rebound completely.

For now, the US dollar index holds under the key 90 level and close to the lowest level seen in three months. In addition to the mood being soured by Fed’s plans for easing, the safe haven appeal of the greenback has also come under pressure as leading economies around the world – especially in Europe, look poised to post rapid recovery from the pandemic-driven slumps.

So far this week, the DXY has lost around 0.6% of its value while the dollar holds close to four-month lows against the common currency. Meanwhile, it holds steady against the safe haven currency Japanese yen but is still set for a weekly loss of 0.5% so far.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account