Polygon (MATIC) Soars on News of Billionaire Mark Cuban’s Investment

Polygon (MATIC) has seen a dramatic surge of almost 40% over the past 24 hours over news that the company has received an investment from

Polygon (MATIC) has seen a dramatic surge of almost 40% over the past 24 hours over news that the company has received an investment from prominent tech billionaire Mark Cuban. At the time of writing, MATIC/USD is trading at around $2.24.

Polygon is an India-based L2 scaling solution for Ethereum founded back in 2017, and was formerly known as Matic Network. Its solution is one of the earliest and easiest scaling and infrastructure development solutions for the Ethereum network. L2 solutions such as Polygon have been gaining considerable attention and popularity with the sudden spurt in interest in the DeFi ecosystem, most of which depends on Ethereum. Such solutions offer a way around issues plaguing the network related to congestion and high gas fees even as they offer the same level of enhanced security for the DeFi projects.

Cuban, with an estimated net worth of over $4 billion, has invested in over 100 companies, with a special focus on crypto projects, especially Ether and Dogecoin. Speaking on the latest development in an interview, Co-founder at Polygon, Sandeep Nailwal, stated, “Getting investment from Mark Cuban in a big stepping stone for Polygon as it will attract more Tier 1 investors in the US towards Polygon ecosystem.”

Polygon calls itself Ethereum’s internet of blockchains and supports interoperability between other blockchain networks and that of Ethereum. Cuban’s investment into the company can increase its adoption, especially among the billionaire’s own set of businesses. According to latest reports, the NBA’s Dallas Mavericks – owned by Cuban, will be integrating Polygon with Lazy.com to leverage its network to display various NFTs on it.

Key Levels to Watch

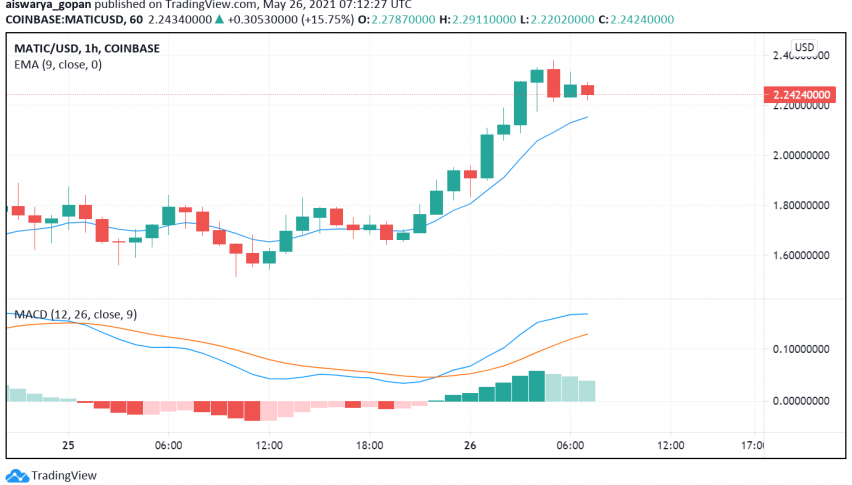

On the 4-hour price chart, moving averages are indicating a bullish bias in MATIC/USD, signaling room for more upside in this digital asset in the near-term. The MACD indicator also aligns with this view and offers hope for the uptrend to continue.

The next immediate level of interest sits at the resistance at $2.80, offering hope that buyers could easily drive its prices higher for now. However, on the other hand, if selling pressure increases amid profit-taking by investors, we could see MATIC’s price dive below the key $2 level, all the way down till $1.50 where it could find some support.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account