US Dollar Gets a Shot in the Arm After Fed Vice Chair’s Comments

The US dollar is enjoying some support in early trading on Thursday after news reports indicate a slight shift in Fed officials' stance

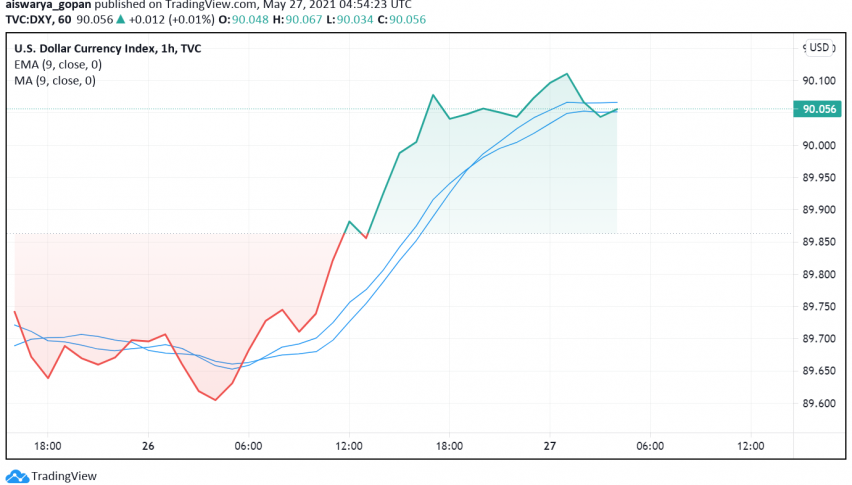

The US dollar is enjoying some support in early trading on Thursday after news reports indicate a slight shift in Fed officials’ stance, with interest building up towards discussing possible measures to start tapering off on monetary easing measures. At the time of writing, the US dollar index DXY is trading around 90.05.

Markets have been solely focused on inflation overheating and the Fed’s expected reaction to such a possibility over the past few weeks. This has caused the dollar to trade under significant pressure against its major peers as Fed officials have repeatedly played down any possibility of stepping in to tighten monetary policy anytime soon, maintaining that they will only act once inflation and employment make a full rebound.

However, during the previous session, investors cheered a slight change in Fed Vice Chair Richard Clarida’s stand on the issue after he admitted that it may soon be time to start talking about changing the dovish outlook towards the US central bank’s monetary policy. His comments gave some hope to markets and drove the benchmark 10-year US Treasury yields higher during the previous session, fueling a round of bullishness in the greenback as well.

Later this week, all eyes will be on the release of core PCE figures from the US as they are a closely watched gauge for inflation. The core PCE is due for release on Friday, with economists expecting an increase to 2.9% YoY during April from the previous month’s reading of +1.8%.

Even though Fed officials, including Chairman Jerome Powell, have repeatedly assured markets that any price rise would be temporary and would not have any adverse long-term impact on consumers or economic recovery, the most recent CPI data coming in stronger than forecast raised concerns all over again. Against the forecast for a 3.6% increase, US CPI rose by 4.2% during April, heightening fears of inflation overheating amid rapid economic recovery even as the Fed continued to stick to its dovish stance for a longer period of time.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account