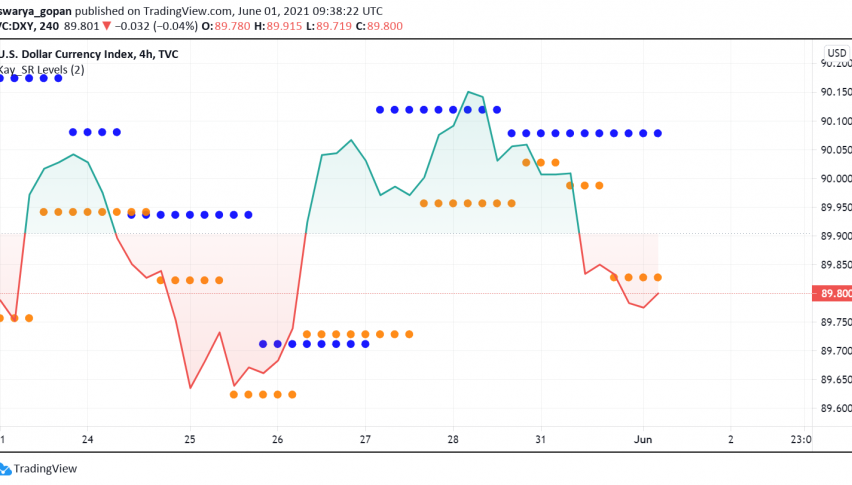

US Dollar Back Below 90 Level Against Major Peers – Fed, NFP in Focus

The US dollar has dropped to trade at the lowest levels seen since several months amid rising uncertainty on whether the Fed would step in

Early on Tuesday, the US dollar has dropped to trade at the lowest levels seen since several months amid rising uncertainty on whether the Fed would step in with tapering efforts sooner than previously planned. At the time of writing, the US dollar index DXY is trading around 89.80.

The greenback has also come under pressure as the market sentiment improves over expectations of economic recovery from the coronavirus crisis around the world. This has helped the GBP strengthen to a three-month high against the US dollar while commodity currency Canadian dollar is nearing a six-year high against the reserve currency.

After rising above the key 90 level late last week after the release of a stronger than expected core PCE reading, the dollar index is back below this level as markets remain cautious about the Fed sticking with its plan to extend monetary easing measures for long. There is also a considerably cautious mood among investors towards the greenback ahead of the release of the non-farm payrolls report at the end of the week.

In addition, markets will also focus on upcoming speeches by Fed officials scheduled for later this week to look for clues on a timeline for tapering asset purchases. This would be the first step towards tightening the central bank’s monetary policy after offering adequate support to the US economy through the crisis.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account