US Dollar Moves Cautiously as Markets Await Employment Figures

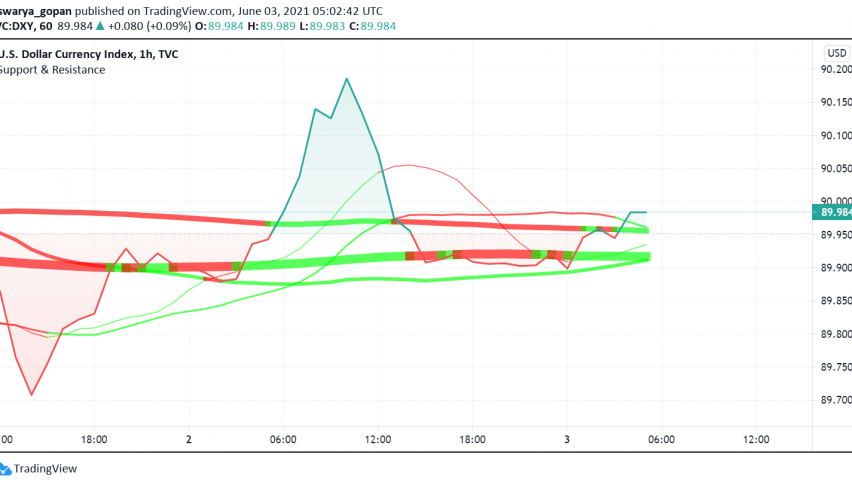

The US dollar is trading with considerable caution early on Thursday, around the key 90 level, as markets eagerly await official employment figures and the Fed’s reaction to dictate moves going forward. At the time of writing, the US dollar index DXY is trading around 89.98.

Until a couple of months ago, economists had predicted extended weakness in the US dollar, especially after Fed’s repeated insistence to stick with ultra-low interest rates and monetary easing until employment and inflation return to pre-pandemic levels in the US. However, they had not anticipated increasing pressure from rising prices as the economy recovers at a rapid pace, which has raised the possibility of the Fed stepping with tightening measures sooner than its initial timeline.

However, there remains considerable uncertainty on the pace of economic recovery in the US, with economic data releases also indicating an uneven pace of progress from the crisis. After inflation gauges have posted stronger than expected readings lately, the spotlight now turns on employment, especially with the release of the non-farm payrolls report for May scheduled to come out on Friday.

Before that, attention will be on the ADP employment report which will shed light on the state of private payrolls in the US. In addition, a series of speeches by Fed officials will also be closely monitored by investors looking for clues on any change in the central bank’s stance or the possibility of starting discussions on tapering bond purchases soon.