Traders Cautious Towards US Dollar, Other Currencies Ahead of ECB Meeting, US CPI

The US dollar continues to exhibit signs of weakness into Wednesday, although it did register a slight rise, with markets hesitant to enter

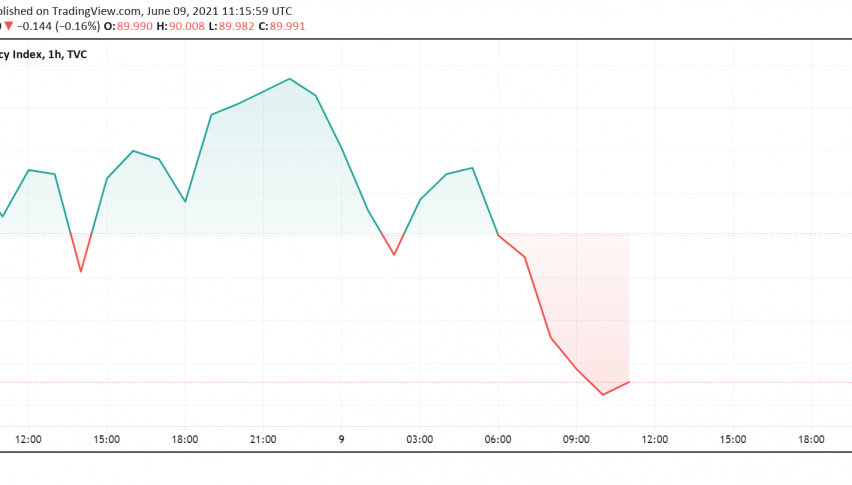

The US dollar continues to exhibit signs of weakness into Wednesday, although it did register a slight rise, with markets hesitant to enter new positions before hearing from the ECB meeting and getting more insights into the condition of US inflation from the release of the CPI report. At the time of writing, the US dollar index DXY is trading around 89.99.

While most investors anticipate that the Fed could extend its monetary easing for longer than several its peers, there are still some that expect a steep increase in inflation to drive the US central bank to speed up tapering measures. In case tomorrow’s CPI report indicates that inflation could rise above 0.4% on a monthly basis, there could be some hope for Fed to step in sooner and overturn its dovish stance, which in turn, could help bond yields rise and boost the US dollar.

In addition, the ECB is also set to hold its meeting on Thursday, ahead of which volatility has become subdued. Markets will pay close attention for any clues or signs that the central bank could ease its bond purchases soon, a move that could drive strength in the Euro and drive it higher especially against the US dollar.

While there were hopes for rapid economic recovery given that the US had and continues to have among the faster COVID-19 vaccine distribution programs, the likelihood of an uneven economic recovery worldwide could exert some pressure in the coming months. It has already resulted in disruptions to the global supply chains and driven up the cost of raw materials while the uneven pace of recovery could also pressure US exports while the labor market remains far from pre-pandemic levels as well – all factors that can slow down the pace of recovery in the US economy and weigh on the US dollar in the coming months.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account