US Dollar Holds Strong After Posting Strongest Weekly Gain in Over a Month

The US dollar is starting the brand new trading week on a somewhat strong footing, holding on to its recent gains against its major peers

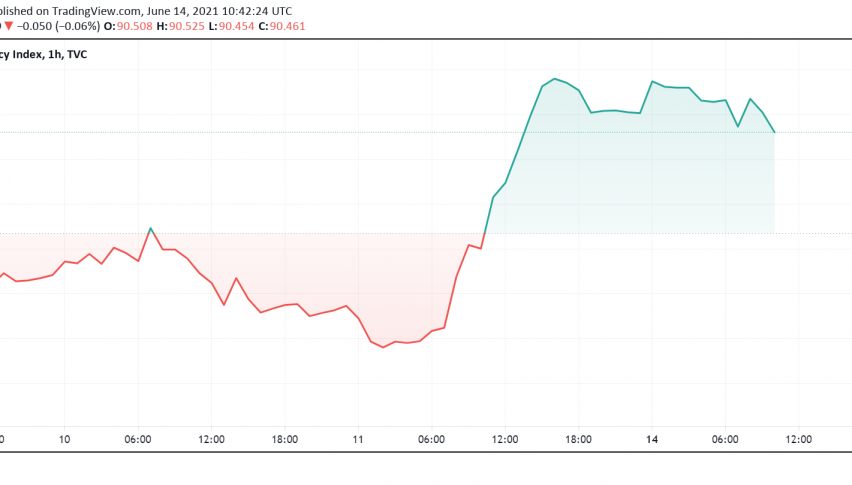

The US dollar is starting the brand new trading week on a somewhat strong footing, holding on to its recent gains against its major peers as traders closed their short positions in the currency ahead of the upcoming FOMC scheduled for this week. At the time of writing, the US dollar index DXY is trading around 90.46.

Despite having no other fundamental drivers supporting it, the greenback ended last week on a high – registering the strongest rise seen in over a month, with the focus shifting on the Fed this week. The dollar index strengthened by 0.4% over the past week after having traded weak against its key rivals for the past several weeks amid rising uncertainty about economic recovery, inflation and possible change in the Fed’s outlook.

There were some analysts who were hoping for the Fed to hint at tapering monetary stimulus measures sooner than planned in the wake of higher inflationary pressures. However, the weaker than forecast employment report for May revealed that the labor market has a long way to go to recover to pre-pandemic levels, while investors are also coming around to the Fed’s thinking that inflation’s effects could be transitory.

With several traders closing their short positions in the US dollar before hearing from Fed officials this week, the US currency hit the highest levels seen in nearly one month against the Euro on Friday and remains close to this level into Monday as well. Meanwhile, the greenback also strengthened against the safe haven currency Japanese yen, trading close to the highest levels seen so far this month.

This week, traders eagerly wait to see if the Fed will offer clues on a possible timeline by when it could consider tapering off stimulus measures, starting with its asset purchase program. Even though the fear of inflation is waning from markets now, the US economy is showing encouraging signs of recovery and the pace of recovery is expected to pick up pace in the coming summer months, which lend some support to the expectation from the Fed.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account