US Dollar Holds Steady – Markets Wait to Hear From Fed on Tapering

The US dollar is holding close to the highest levels seen since one month against its key rivals with investors cautiously awaiting the Fed

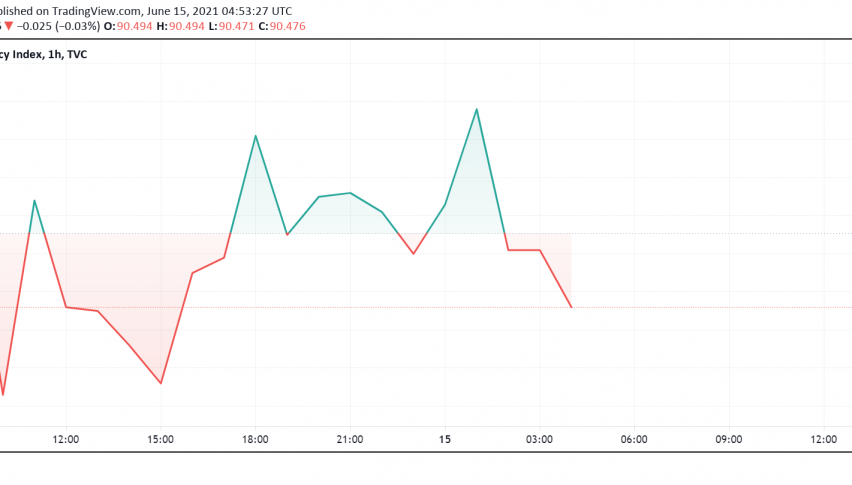

Early on Tuesday, the US dollar is holding close to the highest levels seen since one month against its key rivals with investors cautiously awaiting the outcome of the latest Fed meeting to decide their next moves. At the time of writing, the US dollar index DXY is trading around 90.47.

The two-day FOMC meeting begins later in the day and all eyes will be on the statement for hints about when the US central bank could begin tapering its asset purchase program. While markets have mostly made their peace with the Fed’s outlook that effects of price rise seen lately could be transitory in nature, other indicators pointing to a robust economic recovery in the US have raised expectations that the central bank could begin to look at reversing its dovish stance gradually.

If the Fed goes against expectations and sticks with its policy of continuing with the dovish outlook for a longer period of time until employment and inflation return to pre-pandemic levels, it could spell further weakness in the US dollar. This would be especially severe as other leading central banks like the BOC and the BOE have already started conversations on reducing their stimulus efforts.

In a recent Reuters poll, almost 60% of economists anticipate that the Fed could make an announcement about tapering its initiatives in September. However, traders will closely monitor this month’s meeting for any hints to confirm this timeline, which in itself could send some cheer and drive some strength into the greenback.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account