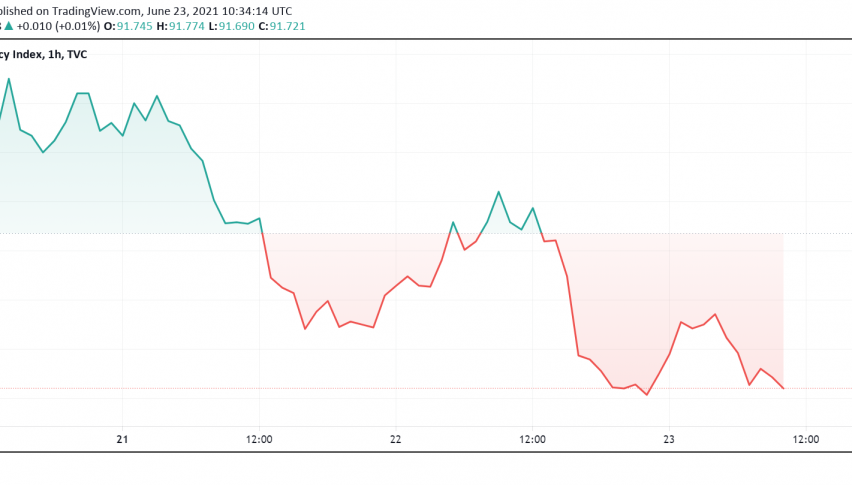

US Dollar Dips as Powell Plays Down Last Week’s Hawkish Tones

The US dollar extends its decline into the third straight session early on Wednesday after comments from Fed officials and chairman Jerome

The US dollar extends its decline into the third straight session early on Wednesday after comments from Fed officials and chairman Jerome Powell played down the hawkish tones from last week’s FOMC, maintaining that it will take some time for a reversal in outlook. At the time of writing, the US dollar index DXY is trading around $91.72, well below the two-month high it soared to in the previous week.

At his congressional testimony, Powell insisted that it will take longer for economic recovery to stabilize before the central bank can even consider pulling out stimulus measures. A similar sentiment was shared by New York Fed President John Williams earlier in the week, exerting pressure on the greenback since the beginning of this week.

Analysts now expect the Fed to share a possible update only by the next policy meeting scheduled for September. By then, the US central bank could feel more confident about the progress made towards economic recovery and offer a timeline by when it could consider starting discussions around tapering off stimulus.

Meanwhile, other leading currencies are trading mostly steady at the start of the day. While the Euro has rebounded from last week’s lows, the AUD and the JPY are holding mostly unchanged into Wednesday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account