Chainlink (LINK) – Where Does it Go From Here?

Why the price should recover over the long-term

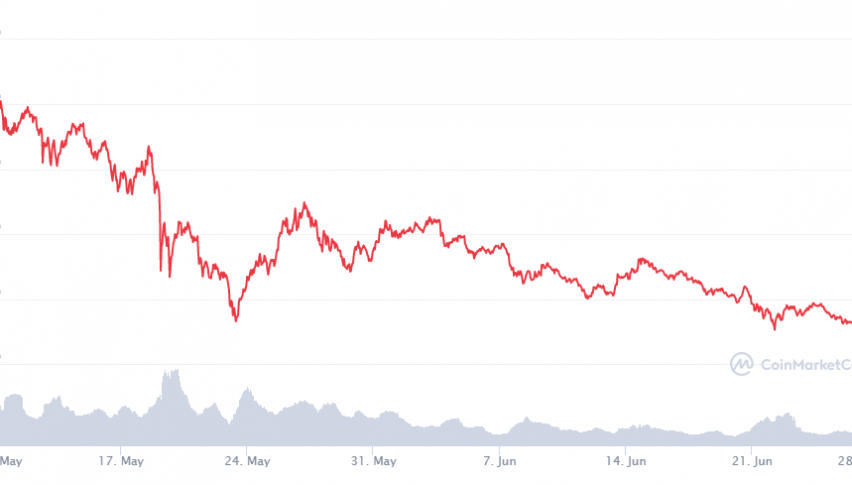

Chainlink (LINK/USD) has suffered a disastrous fall from its highs of $53 in May to $18 at the time of writing. That’s a whopping 65% descent.

Given the token’s meteoric 700% rise last year, which put it among the top five largest cryptocurrencies according to market capitalization, a decline was overdue, and it can largely be attributed to profit-taking by large holders.

But as the old adage goes: “it is always darkest before dawn”. That’s how it is with the blockchain abstraction layer that enables universally connected smart contracts, which was founded in 2017, as it has received a new breath of life with the new and improved Chainlink 2.0 and the increasing adoption of its oracle services by several new projects, like Glitch Finance and Lever.

The new 2.0 version has eliminated a lot of the previous issues that prevented wide-scale adoption of its oracle services. The new “Hybrid Smart Contract” offers an on-chain/off-chain combination, which ties code execution on the blockchain to data and computation from outside the blockchain.

This ensures tamper-proof and immutable contracts, but with the ability to scale, maintain fairness and connect to real-world data, in order to enforce said contracts. This will save a lot of costs in the form of tokens, especially ETH gas that needs to be spent by the user, to enable data to be brought into the Ethereum blockchain, as was the case with smart contracts earlier.

Chainlink Live Chart

Will Chainklink Return to its Former High?

Chainlink was already popular in terms of blockchain financial contracts, and Version 2.0 will only boost its popularity further, as it allows large amounts of financial data to be computed without spending corresponding tokens on the blockchain. As a testament to this, many upstart DeFi projects that are hoping to take off have begun looking at Chainlink for their data feeds, for example, Baking Bad which has announced its new DeFi project on Chainlink.

Despite this new life, Chainlink has not been exempted from the current bear grip on cryptocurrency markets and has seen significant downside volatility, alongside other prominent coins. However, it has bounced back from its long-term support and is now consolidating above it.

A rally is expected on the back of the recent wave of good news and increased adoption of the Oracle framework, especially after the introduction of the hybrid contract. But in order for this rally to materialize, overall market conditions will most likely need to change.

There is currently an overhang of gloom and doom encircling the cryptocurrency market as a whole, and it is bringing a raft of bad news with it, like a Category 5 hurricane making landfall.

The outright banning of crypto mining in China, and the restrictions on transacting cryptocurrencies via debit and credit cards by Absa Bank in South Africa, have compounded the already weary sentiment. Chainlink however, has shown a promise that goes well beyond the cryptocurrency boom of the past several years, and as such will not only survive! It is also likely to climb back to its former position amongst the top cryptocurrencies in the world over the long term.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account