US Dollar Steady Below Two-Month High as Markets Await June’s NFP Figures

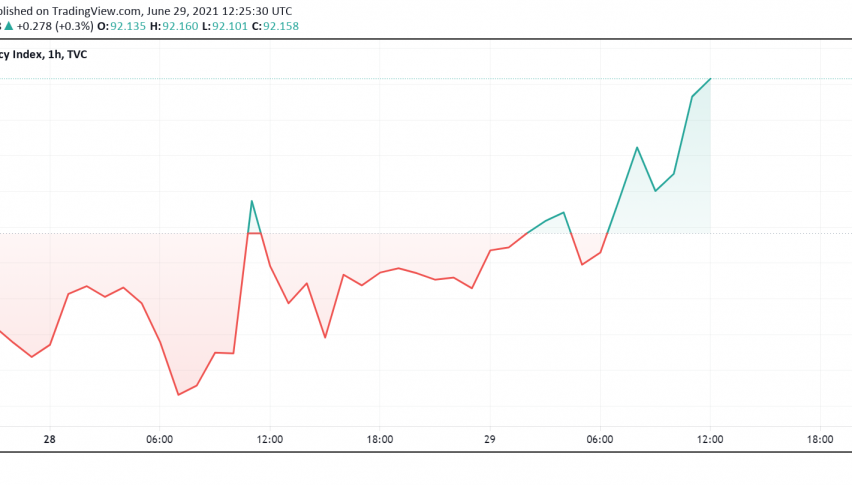

Early on Tuesday, the US dollar is holding close to the highest levels seen since two months against other major currencies with markets

Early on Tuesday, the US dollar is holding close to the highest levels seen since two months against other major currencies with markets hesitant to make moves before the release of the much awaited NFP report for June. At the time of writing, the US dollar index DXY is trading around 92.15.

While the employment report typically drives major moves in the forex markets, lately, it has increased in significance as traders closely watch the health of the US labor market for clues on when the Fed could consider reversing its dovish stance. Since the beginning of the coronavirus pandemic over a year ago, the Fed has cut interest rates to record lows and unleashed several monetary stimulus measures which it insists will continue until inflation and employment rebound fully.

In the latest FOMC meeting, however, markets were dealt an unexpected surprise when the central bank’s policymakers sounded confident of economic recovery and signaled interest in shifting towards a hawkish outlook sooner than originally planned. This helped the US dollar soar to multi-month highs against its key rivals after several weeks of trading under pressure.

Economists recently polled by Reuters sound optimistic that June’s report will show progress in labor market conditions, with an addition of 690k jobs, higher than May’s 559k jobs. Meanwhile, the unemployment rate is also forecast to dip from 5.8% in May to 5.7%. Strong readings could further bolster market hopes for the Fed to start tapering its stimulus measures soon, which in turn could drive bullish moves in the dollar.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account