US Dollar Maintains Strength Amid Risk-off Mood in Markets

The US dollar is holding strong in early trading on Wednesday after receiving a fresh infusion of strength during the previous session as

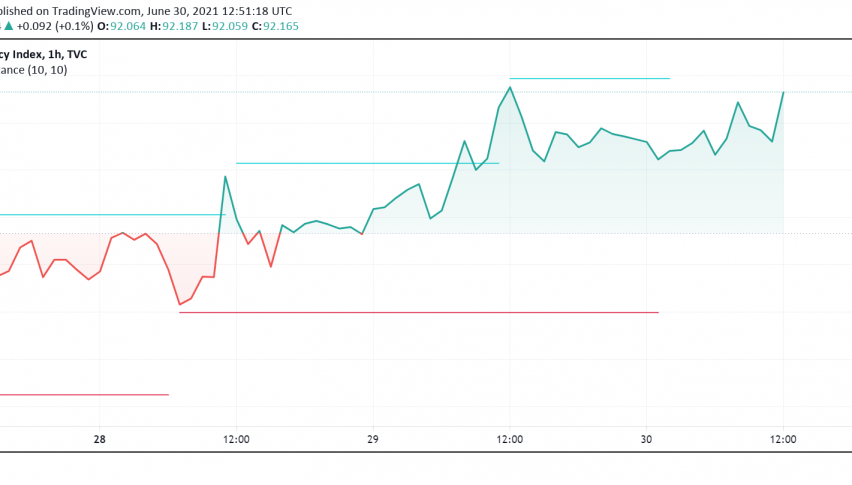

The US dollar is holding strong in early trading on Wednesday after receiving a fresh infusion of strength during the previous session as its safe haven appeal was triggered by a resurgence in COVID-10 cases across several parts of the world. At the time of writing, the US dollar index DXY is trading at around 92.16.

The market mood has shifted to risk-off since the previous session, driving the dollar index higher by 0.2% as Asian countries report a spike in fresh COVID-19 infections and impose strict lockdowns and restrictions, hampering economic activity once again. Meanwhile, the rampant spread of the highly contagious delta variant of the virus has impacted travel out of Britain to other countries.

During the previous session, the US dollar also received a boost from economic data, with consumer confidence across the world’s largest economy soaring to a multi-month high during June. The CB consumer confidence index jumped to 127.3 for June, the highest reading seen since February 2020.

However, gains remain limited as markets cautiously await data related to US labor market conditions due for release through the week. Later today, the focus will be on the ADP private employment report which will offer a sneak peek into the state of employment in the US, before the official non-farm payrolls report releases at the end of the trading week.

The renewed strength in the greenback is causing other major currencies to trade under pressure, most notably the Euro. The EUR/USD currency pair is trading well below the key $1.20 level, holding at around $1.187 at press time.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account