FOMC Minutes Give US Dollar a Boost – More Upside Expected From Hawkish Tones

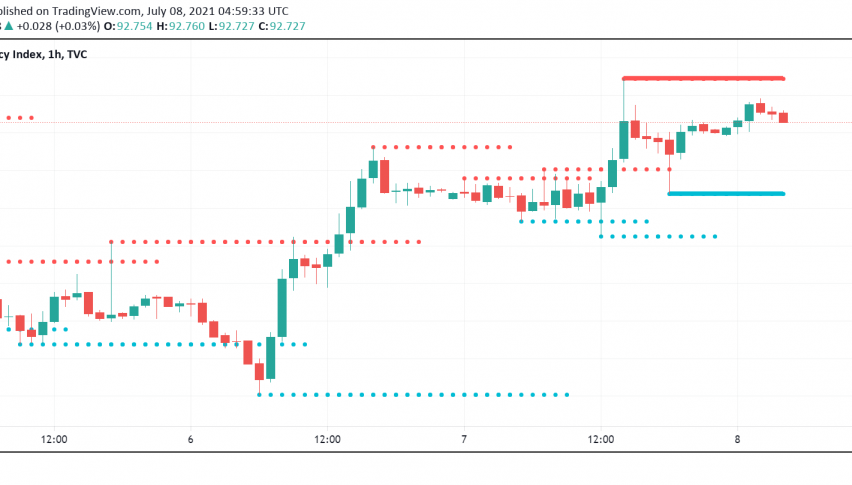

The US dollar continues to trade strong a day after the release of the FOMC minutes confirmed policymakers’ hawkish mood and reinforced expectations for the Fed to start tapering bond purchases sooner than planned. At the time of writing, the US dollar index DXY is trading around 92.72.

In the previous session, the greenback soared to a three-month high of 92.844 against its major rivals, although it has eased lower since then. The minutes also revealed that Fed officials were confident that the economic recovery was making progress, although there was still a long way to go. In addition, they also agreed that they must be ready to step in quickly in the event of high inflation or any other risks that could threaten economic recovery.

The information raised hopes among investors that the Fed could consider beginning the tapering process as soon as within this year, which would further boost the US dollar’s appeal against other currencies. The Euro was one of the most affected currencies among the leading ones, with EUR/USD sliding below the $1.18 level and holding under it since the previous session.

However, against the Japanese yen, the greenback is exhibiting some signs of weakness, sliding lower on the back of a weakening in US Treasury yields. The benchmark 10-year bond yields are holding close to the 1.30% after dipping beneath it on Wednesday.

Now that the FOMC has reaffirmed the Fed’s shift towards winding down monetary stimulus measures, investors will turn their focus back towards employment as the latest weekly jobless claims data is scheduled for release today. Expectations are for the number of initial unemployment claims to decline to 350k from last week’s figure of 364k.