Getting FOMO on Axie Infinity (AXS)? Can I still get in or is it too late?

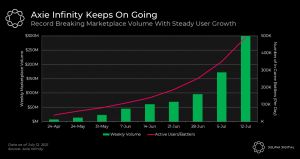

While most of the major cryptocurrencies have been on a downtrend since the crypto crash of May 2021, a little-known Ethereum NFT-based game has slowly been moving higher, and it has now achieved parabolic mooning, just in the past few weeks, with gains of 1,000%+ within this period.

What is Axie Infinity?

Axie Infinity is a Pokemon-like game where you can breed digital pets or “Axies” and use them to play games inside the platform. Axie Infinity Shards (AXS) is the governance cryptocurrency token used for transacting within the Axie Infinity platform.

Players can gain or farm utility tokens, called “Smooth Love Potion (SLP)”, by simply playing the game. Earning SLP has been the driving mechanism for players – it has been producing daily income for them, simply because they have been playing the game. Axie Infinity’s daily active user growth has already exploded to 500,000 active daily users.

Currently, AXS is the 64th-largest cryptocurrency in the world. It has a market capitalization of 1.3 Billion USD.

AXS Trade Idea: Wait for Pullbacks

*Axie Infinity Chart on the daily timeframe: Parabolic move

AXS has broken every resistance level this month and has reached an all-time high, to-the-moon status. Ever since the trend strength ADX momentum indicator reached 30.00, the price has gone parabolic. All pullbacks were bought up only due to demand for the coin (See: PB1, PB2, PB3).

Is it too high now?

The question now is whether it’s too high now to get in the trade? Personally, I do think it’s quite risky to chase and get into this parabolic move. A proper consolidation would be ideal, however, if the demand is really strong, it could easily continue moving higher – there’s no such thing as too high in a powerful parabolic move. But, first and foremost, as traders, we have to manage our risk.

In my opinion, it would be best not to chase the price at this level. It would be better to wait for another pullback, maybe near the 20.00 level, before getting into a trade. Remember that it’s better to be outside a trade, trying to get in, rather than being in a trade and trying to get out. By nature, after reaching their climax, parabolic moves tend to lead to a hard fall as well. Do not get FOMO! There will always be opportunities in the market.

What to do in another Pullback Situation?

In case of a correction, similar to PB1-3 above, wait for the price to have a green day AFTER the red day pullback, to confirm that it is indeed just a short-term pullback and not a sell-off. (Sell-offs are typically large red candles with a high volume. Stay away if this happens.) Buy at the high of the previous red day pullback and put a tight stop loss at the low of the short-term pullback.

AXIE (AXS) Trade Summary: Wait for a short-term pullback similar to PB1-3.

Buy: The next green day after the red day pullback. Trigger entry point is at the high of the red day pullback.

Stop Loss: Put your stop loss at the low of the red day pullback.

VAR: Risk only 0.25-0.50% of your portfolio for this trade.

Take Profits: Sell on strength. Sell half or all if the price rallies.

Remember, this is a quick momentum trade which will entail immediate selling once the trade is validated or invalidated. This means, if it rallies, take the profits immediately, while it is going up. Alternatively, if it does not follow through, sell immediately at break-even or at stop-loss level. The later you get into a parabolic move, the faster you need to buy or sell.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account