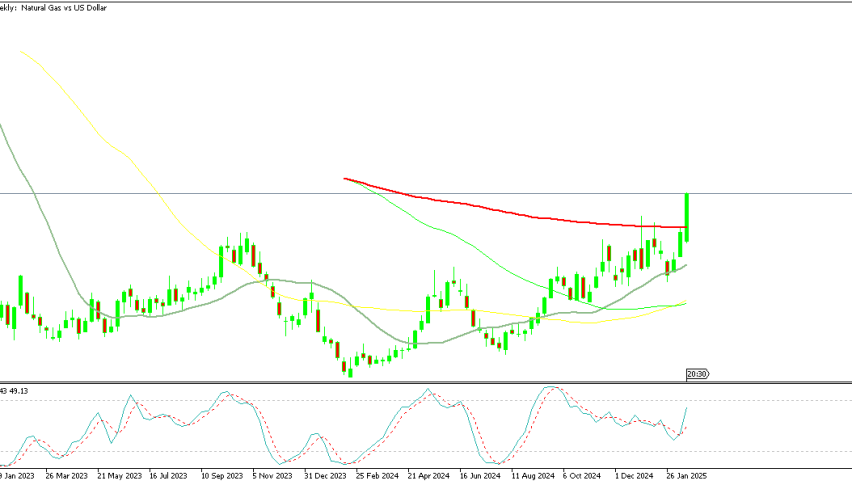

Natural Gas (NG1!) Bidding for a Price of $4.5? Key Levels to Watch

The commodity natural gas has been on a meteoric rise since April this year. Rising demand for the precious commodity, amid continuous recovery from the Covid-19 pandemic, have helped the surge in NG1!.

This valuable natural resource climbed from a low of around $2.5 on April 6 to a recent high of $4.18 on July 26. Now, natural gas is likely to be headed towards higher highs.

NG1! – A Technical Outlook

Natural Gas 4-hour Chart Analysis

From the 4-hour chart, we can see that natural gas has retreated from a high of $4.18. However, analysts are projecting higher prices ahead.

What Could be Causing the Surge in NG1! Prices?

Supply constraints: Scorching summer weather has raised concerns of a tight supply as consumers have raised the demand for electricity to run their air conditioners. According to Bloomberg, underground storage of US natural gas is now about 6.2% below the normal volume.

Winter demand anticipations: With natural gas stockpiles running low, there are further concerns of undersupply when the US gets into the winter season. As can be expected, consumption of natural gas peaks during winter when households and businesses heat their premises.

NG1! Predictions

Going forward, I predict that natural gas will continue the bullish run it embarked on in April. Already on July 29, data released by the US Energy Information Administration showed that utilities added about 36 billion cubic feet of gas to the stored stocks for the week ending July 23. The addition was less than the expected 43 bcf. NG1! rose briefly following this news.

With the natural gas stockpiles getting lower and less being added to the grid, the anticipated demand in the winter could see NG1! reach the previous price of $4.5, or it could even break higher.

Key Levels to Watch for NG1! Buy

$3.832 – This level has acted as a market event area/minor support. Prices could be contained here from the current drop, before getting higher bids.

$3.534 – This level has also been important to NG1! as prices have tested it as a support before bouncing back. If prices break below the support at $3.832, the level should be the next area of interest for natural gas traders.

What to Watch for NG1!

As a trader, I will keep a keen eye on key developments in the market for further clues on potential moves in the natural gas prices. I will monitor news regarding market supply, as this will give me some pointers towards further moves in the price.

As for now, I would recommend that traders watch for key trade signals at the mentioned levels and consider buy trades accordingly, in line with the bullish momentum in NG1! Good Luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account