Ethereum Struggling Below 3,345 – Brace for a Breakout

The ETH/USD closed at $3228.54 after reaching a high of $3346.21 and a low of $3145.69. ETH/USD remained under heavy pressure

The ETH/USD closed at $3,228.54, after reaching a high of $3,346.21, and a low of $3,145.69. ETH/USD remained under heavy pressure throughout the trading session, closing the session at the same level at which it started. The prices of ETH/USD tried to rise during the first half of the session, but failed to hold their position, reversing their course amid the recent sell-off in the market.

ETH/USD remained under pressure on Monday, as the whole cryptocurrency market mood was depressed. The Ethereum blockchain implemented the London hard fork about 25 days ago, and a number of features were added to the network. One of the most anticipated changes was the EIP-1559, which made the ETH deflationary by burning a certain fraction of coins.

ETH/USD faces selling pressure due to high gas fees, which are continuously making Ethereum less desirable, as the number of Ethereum-Killers and the competition in general are rising. Many blockchains provide a similar platform for DeFi and smart contracts, like Binance Smart Chain, Solana, Polkadot, Cardano and EOS, which, by comparison, provide their services at a lower cost, and developers are inclining more towards them. The rising number of competitors in the market is also weighing down the ETH prices, as the Ethereum development team is working on resolving the gas fee issue and continues to work on the main project of Ethereum 2.0.

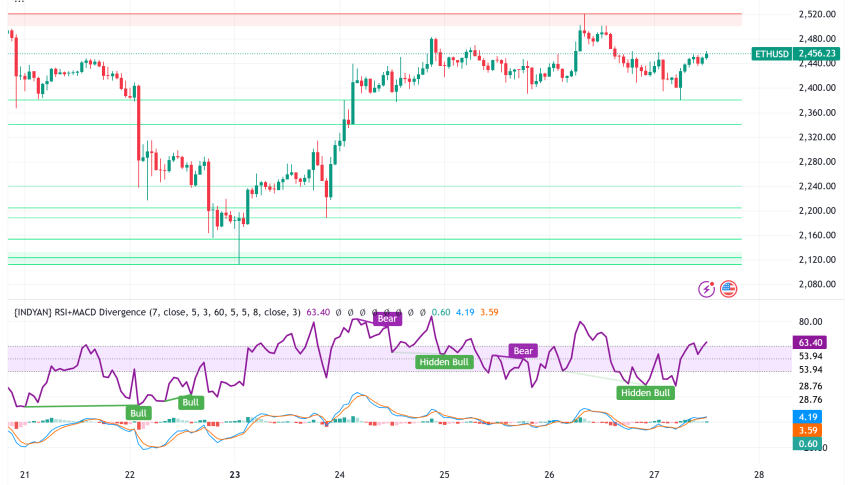

Ethereum-ETH/USD – Daily Technical Outlook

The second most popular crypto pair, ETH/USD, is currently trading at around 3,329, with a neutral bias. The 3,240 level is providing immediate support, while the 3,340 level is providing resistance. A bullish crossover above 3,340 might push the price of ETH towards the 3,445 level. The Stochastic is at 59, indicating that the ETH/USD pair is on a bullish trend.

Daily Technical Levels

3,134.09 3,334.61

3,039.63 3,440.67

2,933.57 3,535.13

Pivot Point: 3,240.15

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account