Binance Cash Completes 38.2% Fibonacci Correction – Capture a Pullback

The BNB/USD ended the day at $551.50, with a high of $551.90, and a low of $511.80. Binance cash soared yesterday, reaching its highest level since mid-May 2021, owing to positive developments in the Binance coin ecosystem.

The Binance smart chain network is gaining traction, as all metrics point toward the usage of the BSC blockchain returning to its heights of July 2021. The native token of Binance Smart Chain, BNB, has surged massively as a result.

The Binance Smart Chain has revealed its plans to introduce a fee-burning mechanism, like Ethereum, in the form of Binance Evolution Protocol (BEP-95). It will force the network to adopt an ongoing fee-burning mechanism that permanently pulls tokens from the circulating supply. It will be similar to EIP-1559, which has already burned about $2.1 billion worth of ETH tokens. The reduction in the circulating supply of ETH ended up pushing ETH prices higher, and this resulted in expectations for a potential increase in the value of the BNB coin.

Implementing BEP might decrease the total amount of BNB that validators and delegators receive from staking, and the number of rewards could also decrease as a result. The supply of BNB will decrease further, thus increasing the demand for the token, which will, in turn, push its prices higher. These expectations kept BNB/USD higher on Monday.

Daily Technical Levels:

Support Resistance

524.90 565.00

498.30 578.50

484.80 605.10

Pivot Point: 538.40

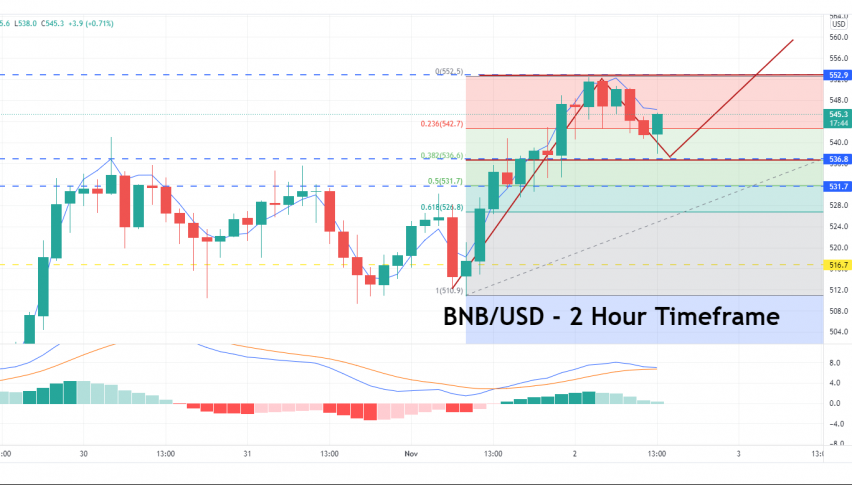

Binance Cash price prediction: Buy limit at the 38.2% Fibonacci Retracement

Binance cash is trading with a bullish bias at the $540 level; however, it has made a bearish turn for a correction. On the lower side, BNB cash is gaining immediate support at the $536 level, extended by the 38.2% Fibonacci correction level.

Further to the downside, the next support is likely to be found at around the 50% and 61.8% Fibonacci retracement levels, at $531 and $526. At the same time, a breakout at the $552 level would expose the pair to $565. Let’s consider staying bearish below $552 and vice versa. Good luck!