US Dollar Still Strong as Euro Falters – Europe Lockdowns in Focus

The US dollar is holding on to its recent gains against other leading currencies of the world, especially the Euro, as markets worry about

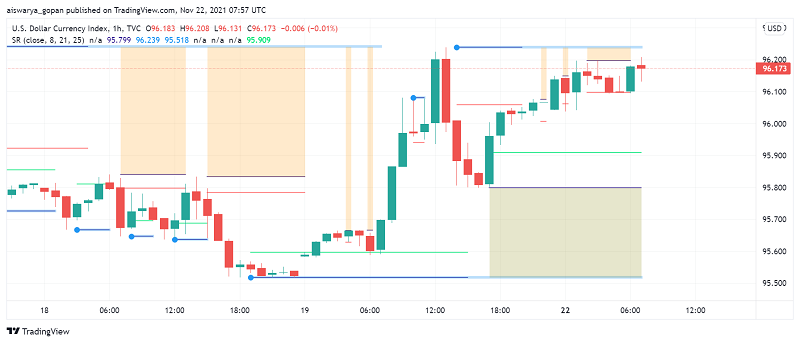

The US dollar is holding on to its recent gains against other leading currencies of the world, especially the Euro, as markets worry about the spike in COVID-19 infections across Europe, forcing several nations to impose tighter lockdowns and curbs as they battle to contain the fresh outbreak. At the time of writing, the US dollar index DXY is trading around 96.17.

The greenback has been climbing higher, being supported by its safe haven appeal in global markets, as investors worry about the economic fallout of Europe heading back into lockdown despite a widespread rollout of the COVID-19 vaccine. The uncertainties have sent investors away from the common currency as they fear about a possible slowdown in Europe’s economic recovery from the coronavirus crisis towards the end of the year.

The outlook for EUR/USD, which was already weak amid an extended dovish mood by the ECB, worsened further after Austria imposed a complete lockdown and Germany said it would look to tighten its restrictions. Germany’s health minister, Jens Spahn, has already cautioned that COVID-19 vaccinations are insufficient in preventing the spread of infections, in the wake of rising deaths due to the infection.

In addition, the US currency is also on the rise against major commodity currency CAD, especially on the back of weakening crude oil prices in international markets. The prevalent risk-off mood in the markets has also caused other risk-sensitive commodity currencies like AUD and NZD trade bearish against the USD.

The US dollar is also trending higher after Fed officials hinted at speeding up the process of withdrawing monetary stimulus as the US economic recovery picks up pace and inflation climbs higher. these comments have further served to reinforce rising hopes for faster rate hikes by the Fed, well ahead of the central bank’s original timeline of 2023.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account