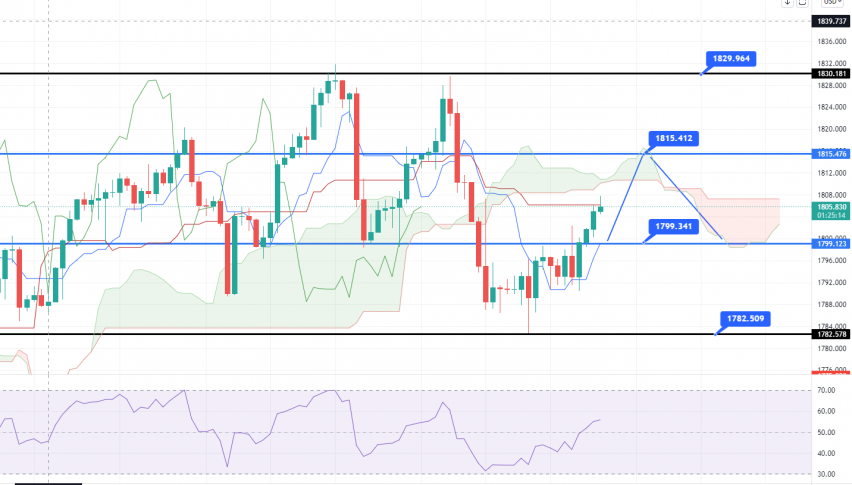

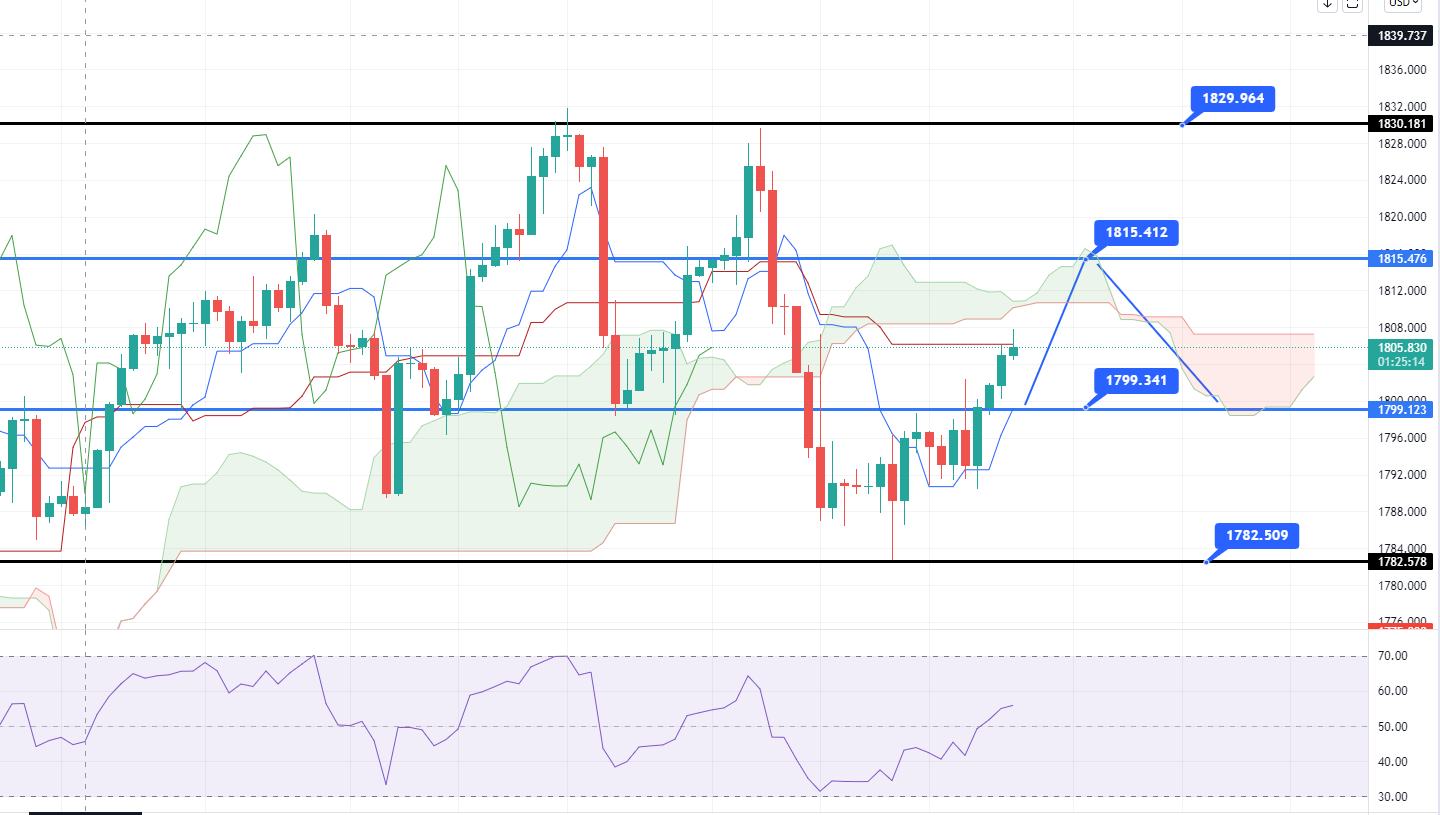

Gold bounces to $1,805 – Why XAU/USD Could Recover to $1,815?

The precious metal gold is trading with a strong bullish bias at 1,805, having recovered above the $1,799 resistance level. This level is no

Gold prices closed at $1,801.10, after hitting a high of $1,802.50, and a low of $1,789.45. Gold continued its upward momentum and made a few small gains on Monday, to recover some of its previous losses. On Monday, the sudden drop in the US Treasury Yield, on a benchmark 10-year note, could be attributed to rising gold prices. After rising for five consecutive sessions, the US Treasury yield dropped to 1.75% on Monday, which helped gold turn green for the day. The US Dollar Index (DXY), which measures the value of the US dollar against a basket of six major currencies, remains strong for the day, hovering at around 95.99.

The benchmark US Treasury yields hit their highest level in almost two years on Monday, as expectations among market participants, that the US Central Bank will start tightening its policy with an interest rate hike as soon as March, are increasing. However, after hitting a 2-year high, the Treasury yields started to decline, probably because of the price correction, and gold gathered strength from its decline.

US Inflation figures in Focus

Investors now await the release of the CPI report, which is due on Wednesday, as it will provide a better picture of the Fed’s upcoming decision on rate hikes. The need for a rate hike has been increased, due to the rapid surge in consumer prices and inflation levels. Gold is considered a hedge against higher inflation, but the talk of rate hikes is weighing on gold, as this tends to increase the opportunity cost of holding non-yielding bullion. This is why the gains in gold remained somewhat limited on Monday.

On the data front, there was not much information to be released from the US. At 20:00 GMT, the Final Wholesale Inventories came in, showing a surge to 1.4%, against the expected 1.2%, which weighed on the US dollar, ultimately pushing gold further to the upside. Another reason behind the steady movement of the gold prices could be the latest prediction by Goldman Sachs, of a rate hike.

The investment bank revised its prediction, estimating that the Fed will raise interest rates four times this year, and begin reducing the size of its balance sheet as early as July. Earlier, the bank predicted three rate hikes in 2022, in March, June and September. However, the bank now expects another rate hike in December, which added further pressure to gold prices, capping gains on Monday.

Furthermore, on Monday, the Chief Executive Officer of Pfizer, Albert Bourla, said that Pfizer was working on developing a vaccine that will be effective against the Omicron variant. He said that the vaccine would be ready as soon as March, and stated that two vaccine shots and a booster shot have already provided reasonable protection against the serious health effects of Omicron. As yet, he is unsure whether there will be a need for another specific vaccine for the Omicron variant. These comments by Bourla capped any further gains in gold, as they reduced the risk-off market sentiment.

Gold (XAU/USD) – Technical Outlook

The precious metal, gold, is trading with a strong bullish bias at 1,805, having recovered above the $1,799 resistance level, which is now acting as a support for gold. Further to the upside, the next resistance remains at 1,815, and a break above this could lead the gold price towards the 1,829 level.

Daily Technical Levels

Support Resistance

1,792.86 1,805.91

1,784.63 1,819.73

1,779.81 1,818.96

Pivot Point: 1,797.68

On the lower side, the support is holding at around 1,799, and a break below this could extend the selling trend until the 1,782 level. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account