Gold Price Starts Upward Momentum, Can Bulls Target 1,830?

Gold prices closed at $1,820.40, after placing a high of $1,828.15, and a low of $1,811.85. After posting gains for four consecutive sessions, gold dropped on Thursday, despite declining US Treasury Yields and a weak US dollar. The US dollar index, which measures the value of the greenback against a basket of six major currencies, extended its losses, declining for the third consecutive session, to reach its lowest level in three months, at 94.66 points. The US Treasury Yield, on benchmark 10-year note, also dropped, coming in at 1.69%, which is the lowest figure in six days.

Gold Rate Live

The Federal Budget Balance, which was released at 00:00 GMT, dropped to -21.3B against the forecast of -5.8B, supporting the US dollar. At 18:30 GMT, the PPI figures came in, showing a drop to 0.2%, against the anticipated 0.4%, which weighed on the US dollar. The Core PPI remained flat, in line with the expected 0.5%. The Unemployment Claims surged to 230K against the expected 199K, putting downside pressure on the US dollar. Most data from the US side was unfavorable, which capped further losses in the gold prices.

On Thursday, the Federal Reserve governor, Lael Brainard, told Congress that reducing inflation was the central bank’s most important task. Ms. Brainard added to the expectations of rate hikes as she pointed out how the central bank was working to end the asset-buying stimulus program no later than March.

According to her, the Fed’s rate-setting committee has proposed several rate hikes this year. However, this can only be done if asset purchases are terminated as soon as possible. She said that bottlenecks and other supply constraints were contributing to much higher energy and food prices, but she added that the Fed was prepared to increase interest rates to cool down demand across the economy, as necessary, in order to reduce inflation. She also said that the Fed has a powerful tool and will use it to bring inflation down over time. She also predicted that the higher inflation rate is expected to persist through the next couple of quarters.

The comments by Ms. Brainard put negative pressure on precious metals, as higher inflation tends to push the demand for safe-havens to the upside. Furthermore, the World Health Organization has added two more drugs to its list of guidelines for recommended treatments for the coronavirus, amid the surging numbers of cases worldwide, due to the rapid spread of the Omicron variant.

According to the agency’s experts, the drug, Baricitinib, is highly recommended for patients with severe and critical COVID-19. The experts also gave a conditional recommendation for another drug named Sotroviman, for those with non-severe coronavirus conditions, but at a very high risk of hospital admission. The accelerated pandemic throughout the world prompted the WHO to recommend new treatments, which further boosted the risk on market sentiment, dragging gold further to the downside.

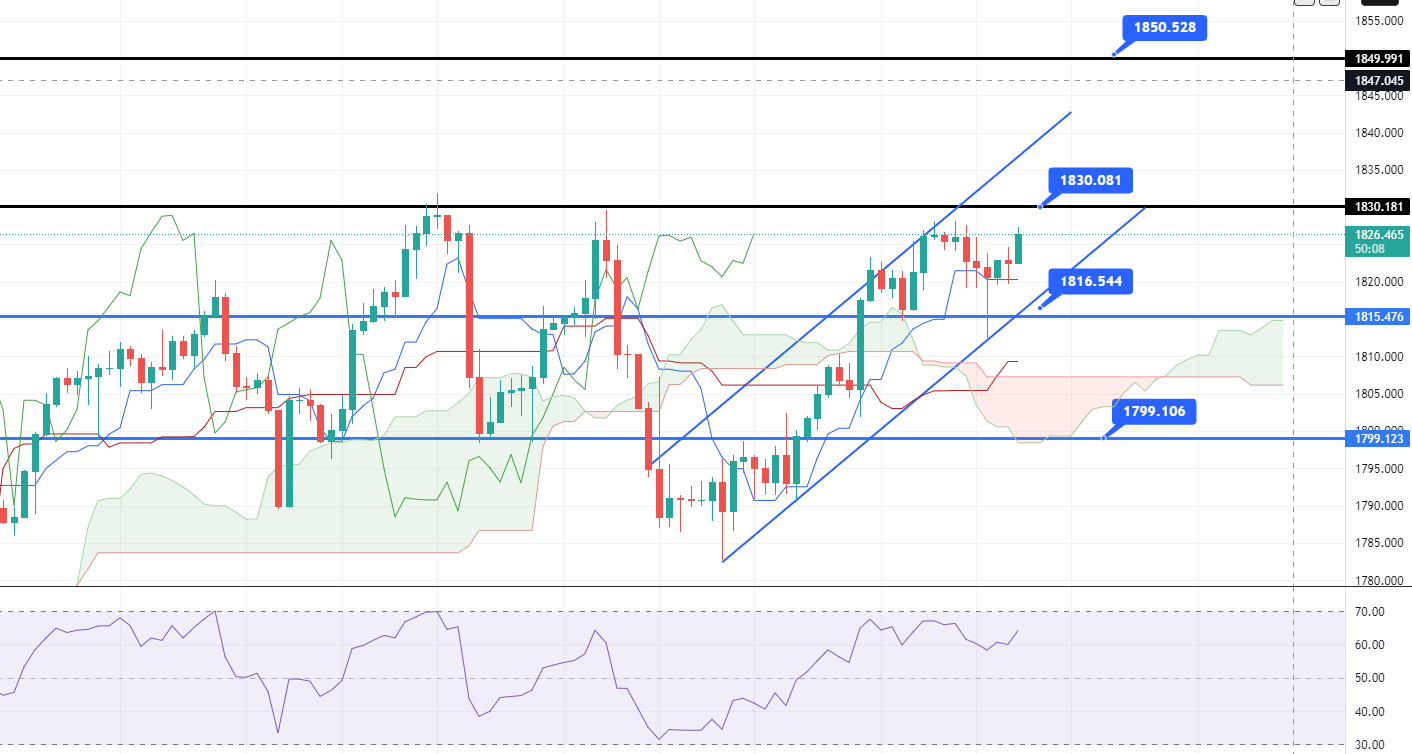

A Technical Outlook on Gold – The Uptrend Continues Above $1,820

The precious metal, gold, is trading at 1,826, with a strong bullish bias, having violated the resistance level at $1,815. This level is acting as a support for gold. Further to the upside, the next resistance remains at 1,832, and a break above this could lead the gold price towards the 1,845 level.

Daily Technical Levels

Support Resistance

1,812.11 1,828.41

1,803.83 1,836.43

1,795.81 1,844.71

Pivot Point: 1,820.13

On the lower side, the support is holding at around 1,820, and a break below this level could extend the selling trend until the 1,804 level. Good luck!