Forex Markets Await US Inflation Data

An improvement in the market sentiment has helped commodity currencies AUD and NZD edge higher, although moves in the forex market remain

An improvement in the market sentiment has helped commodity currencies AUD and NZD edge higher, although moves in the forex market remain limited as traders await US inflation data before making fresh moves. At the time of writing, the US dollar index DXY is trading around 95.54.

After touching the highest levels seen in three weeks during the previous session, AUD/USD has eased slight lower in early trading. An uptick in global commodity prices, higher risk appetite among investors worldwide and cautious moves in the US dollar ahead of the CPI report’s release today are supporting the bullish mood in this currency pair for now.

These sentiments also also helping NZD/USD trade close to two-week highs on Thursday. Meanwhile, USD/JPY is trading bullish on account of the risk-on mood in the global markets, which is exerting downward pressure on the safe haven currency Japanese yen.

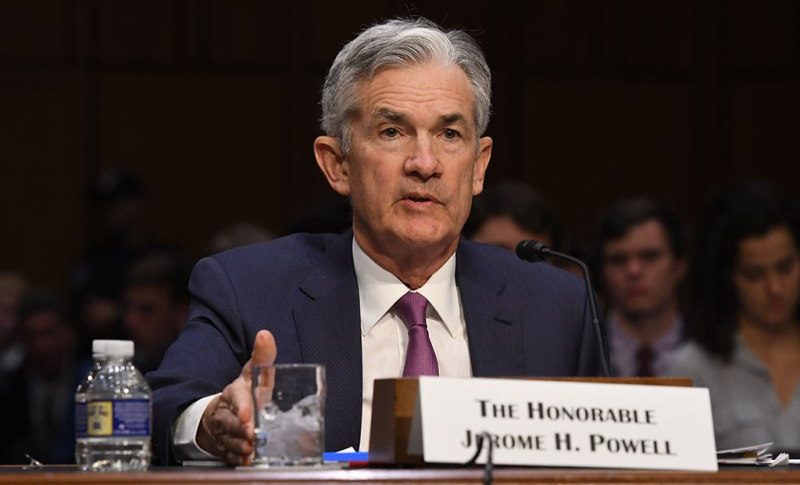

Moves in the currency market remain muted as investors wait for the consumer price data from the US scheduled to release later today. A stronger than forecast reading will reinforce expectations for a more hawkish Fed in the coming months, which can drive up buying activity in the US dollar.

According to economists, US CPI is expected to come in at +0.5% MoM and 7.3% YoY for the month of January. A reading that beats these forecasts can support the greenback in the short term, raising the likelihood of a 50bp rate hike by the Fed in March and a more aggressive approach towards monetary tightening to offset the impact of soaring inflation on the US economy.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account