EUR/USD Rises as Central Banks Join Forces to Avoid Liquidity Crunch

The euro is strengthening against the dollar to start the week, hovering around 1.0680.

The euro is strengthening against the dollar to start the week, hovering around 1.0680. The UBS-Credit Suisse transaction and the combined efforts of major central banks to prevent a liquidity crisis have supported the rebound of US Treasury bond yields and the US Dollar, propelling the currency pair higher for three days in a row.

Nevertheless, hawkish remarks from European Central Bank (ECB) officials appear to be bolstering demand for the Euro.

Christine Lagarde, president of the European Central Bank, responded to the Swiss National Bank’s defense of Credit Suisse by saying that the ECB is hopeful that the Swiss-brokered rescue of Credit Suisse will restore calm in financial markets. Many European Central Bank officials sought to calm markets and reassure investors by defending the ECB’s aggressive monetary policy stance and the stability of the bloc’s banks on Friday. The officials, notably Madis Muller of the Governing Council, Francois Villeroy de Galhau of the ECB Board, Peter Kazimir of the ECB Policy Committee, and Gediminas imkus of the Governing Council, all made hawkish statements.

Meanwhile, the EUR/USD has been underpinned by the gloomy US Dollar data and declining Treasury bond yields. According to the University of Michigan’s (UoM) Consumer Confidence Index, consumer optimism in the United States fell to 63.4 in March from 67.0 in February and March of last year. Inflation projections for the next year fell from 4.1% in February to 3.8%, the lowest level since April 2021, while projections for the next five years fell from 2.9% to 2.8%. In addition, February’s US Industrial Output was flat, compared to forecasts of 0.2% growth and a previously reported 0.3% increase in January.

Standing US dollar liquidity swap line arrangements will be announced by the Bank of Canada, Bank of England, Bank of Japan, European Central Bank, Federal Reserve, and Swiss National Bank. UBS is planning to acquire Credit Suisse for an estimated 3 billion Swiss francs (£2.6bn).

The speech by ECB President Lagarde tomorrow could provide traders with some immediate guidance for the EUR/USD pair. Although if the Fed’s 0.25% rate hike is an inevitability, this week’s most important event is the announcement of monetary policy from the Federal Open Market Committee (FOMC) meeting on Wednesday. The initial PMI results for the month of March are also very significant. Euro pair traders should pay special attention to risk triggers and U.S. Treasury bond yields for directional clues.

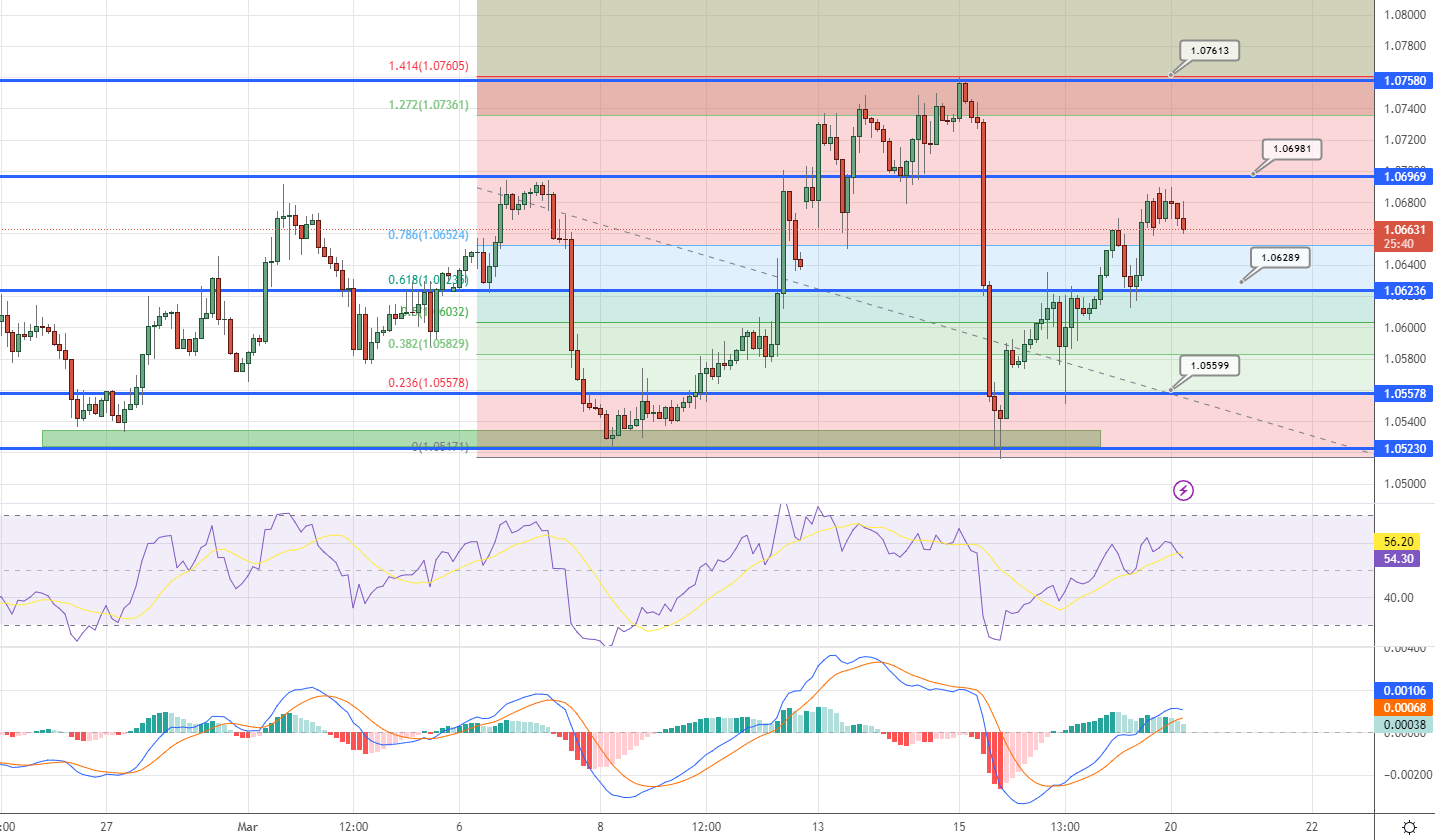

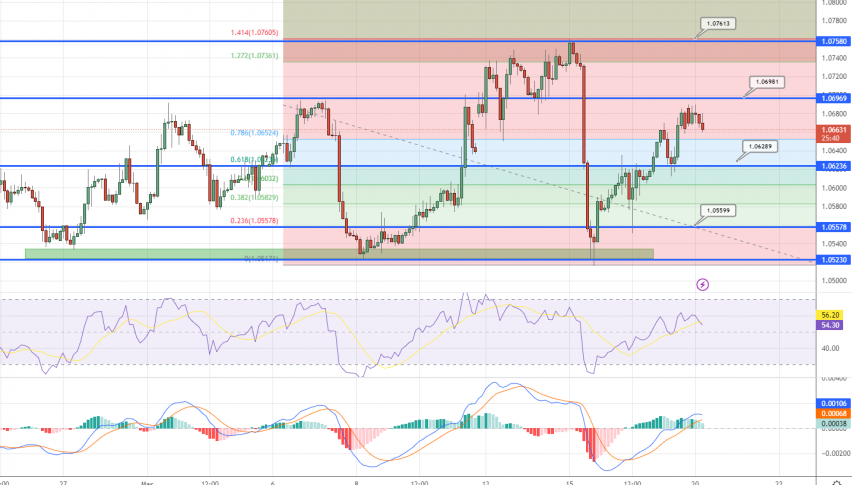

EUR/USD Technical Outlook

The EUR/USD bulls will need to see daily closing prices above the 50-day moving average (DMA) near 1.0730 to regain confidence in their position. Conversely, a retracement of the major currency pair remains elusive unless the quote maintains a distance above the 100-day moving average, or 1.0575.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account