EUR/USD Shows Mixed Performance Ahead of Federal Reserve’s Interest Rate Decision

Traders and investors appear to be waiting for the Federal Reserve’s (Fed) interest rate decision, as the euro-dollar exchange rate has remained within a tight range above the round-level support of 1.0700 in the Asian session.

Therefore, the major currency pair is expected to maintain its sideways trading pattern seen prior to the introduction of Fed policy.

As investors welcome liquidity assistance from various financial institutions to First Republic Bank following solvency concerns, S&P500 futures continue to gain, extending Monday’s recovery.

This shows that investors are becoming more responsible in their efforts to reduce financial instability, and it also suggests that risk appetite is on the mend.

As investors wait to see what the Federal Reserve does with interest rates, the US Dollar Index (DXY) is stagnating around 103.30.

Elon Musk, CEO of Tesla, a company dedicated to creating futuristic automobiles, recently said that the Federal Reserve should lower interest rates by at least 50 basis points (bps) due to fears that monetary policy tightening will cause a recession.

Despite this, there is a continued lack of interest in purchasing US government bonds because the offered return is so high.

The promise of a $30 billion infusion of liquidity to support First Republic Bank has helped keep 10-year US Treasury yields at their current level of 3.5 percent as of this writing.

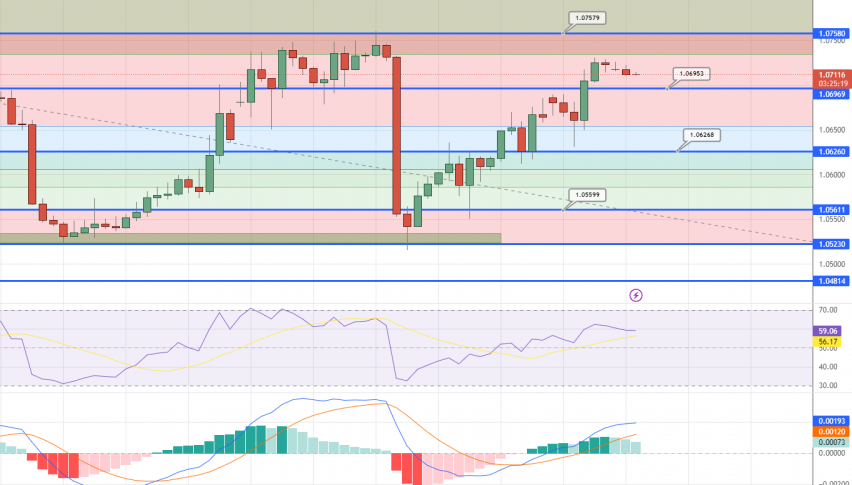

EUR/USD Technical Outlook

The EUR/USD has continued to increase and is now very close to our waited target at 1.0745, which provides good resistance against the price and we need to have strong positive motivation that pushes the price to surpass this level and open the door to make more gains that reach 1.0800.

Although a break below 1.0650 would halt the predicted gain and put pressure on the price to revert to decline, heading towards hitting 1.0515 regions primarily, we continue to recommend a positive intraday outlook as the EMA50 carries the price from below.