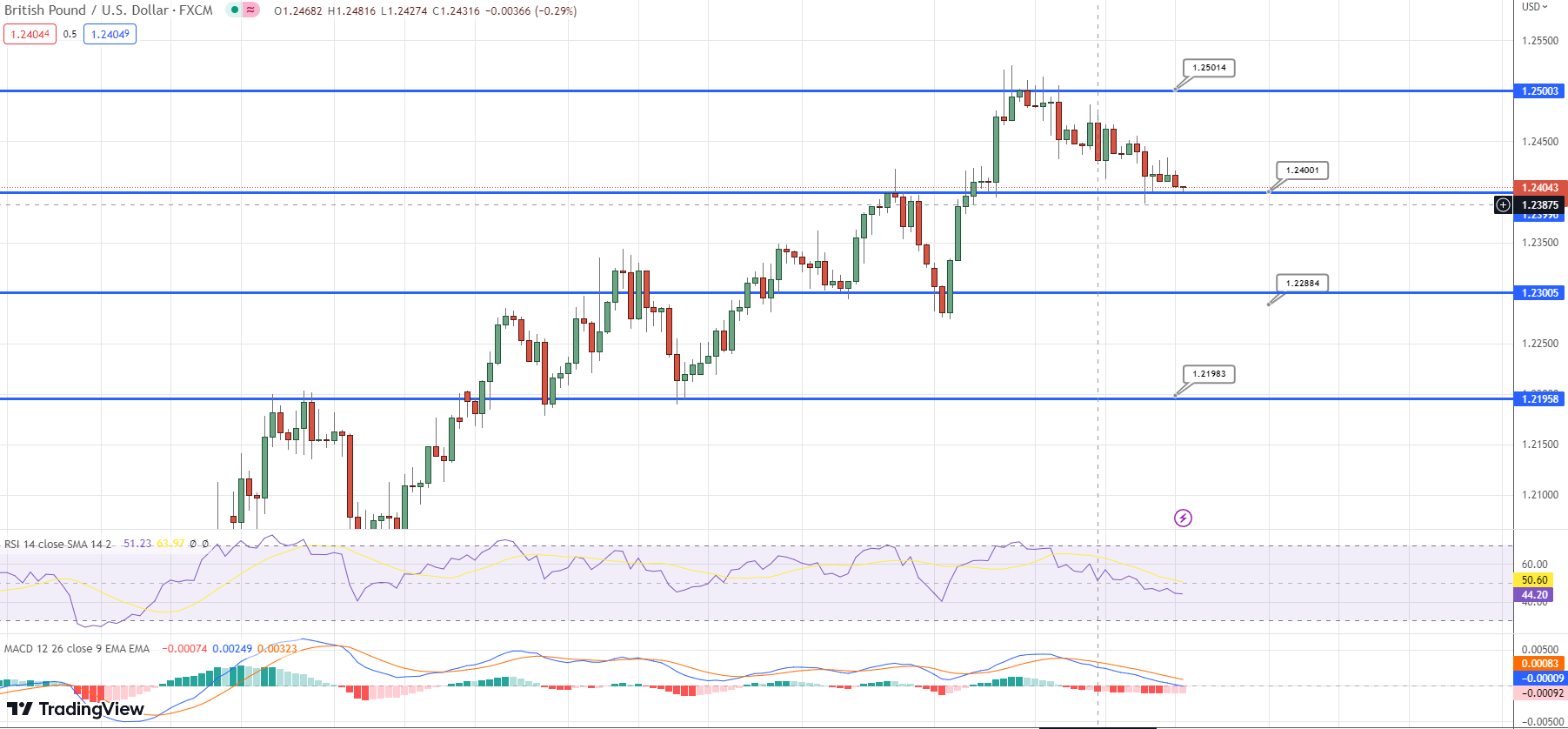

GBP/USD drops to intraday low amid US Dollar recovery and China tensions

On Easter Monday morning in London, the GBP/USD pair refreshed its intraday low near 1.2400 for the fourth consecutive day, as the US Dollar recovers in a risk-off environment.

On Easter Monday morning in London, the GBP/USD pair refreshed its intraday low near 1.2400 for the fourth consecutive day, as the US Dollar recovers in a risk-off environment. The US Federal Reserve’s (Fed) hawkish expectations, compared to recent doubts about the Bank of England’s (BoE) next move, may contribute to the pullback moves.

The US Dollar’s rebound is bolstered by fears from China due to military drills near the Taiwan Strait, triggered by Taiwan President Tsai Ing-wen’s US visit. Meanwhile, the Fed’s renewed bets on a May-month rate hike are supported by the recently firmer US Nonfarm Payrolls (NFP). The CME’s FedWatch Tool suggests a 66% likelihood of a 0.25% rate hike in May.

In contrast, the Bank of England (BoE) officials appear less hawkish, with a pause in the rate hike trajectory, even as UK inflation remains a concern.

The S&P 500 Futures remain directionless around 4,130, after a two-day uptrend, while the US 10-year and two-year Treasury bond yields remain under pressure near 3.37% and 3.95%, respectively. As a result, the benchmark bond coupons continue to extend the previous day’s losses, reflecting the market’s rush towards risk-safety amid economic slowdown fears. The GBP/USD pair’s intraday movements may be restricted due to the Easter Monday holiday.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account