Gold Price Surpasses $2,000 Mark Amid Risk-Averse Sentiment – Focus on US Inflation and Fed Meeting

The safe-haven gold price extended its upward rally.

The safe-haven gold price extended its upward rally. It hit around $2,000 as investors anticipated additional clues on the US economy from inflation data and the Federal Reserve’s March meeting minutes, which are coming later this week.

It’s important to note that gold prices experienced a modest drop earlier this week but quickly regained momentum as investors started to ignore hawkish predictions from the Federal Reserve. However, the possibility of a hawkish stance was heightened after the release of last week’s US employment data, which indicated an improvement in the labor market.

However, the latest bullish rally in gold prices was driven by its high safe-haven demand amid concerns about slowing economic growth and uncertainty regarding monetary policies. As investors become worried about the prospects of the economy and uncertain about the direction of monetary policies, they tend to turn to gold as a safe-haven investment. Hence, this high demand for gold has helped drive its price, leading to the recent bullish rally.

Gold Prices May Continue to Rise Amid Uncertain Market Conditions

The US economy has been sending mixed signals lately, making investors uncertain about what to expect. This has raised the demand for safe-haven assets such as gold. On the other hand, the US nonfarm payroll data that was already out showed that the job market stayed strong in March. This led the Federal Reserve to make hawkish predictions and caused gold prices to drop from their recent high.

Although, the declines were short-lived as investors started to ignore hawkish bets and started focusing on upcoming consumer price index inflation data and the Federal Reserve’s meeting minutes, which are expected to have an impact on gold prices in the coming days.

Thus, If the data shows a high inflation rate and the Fed plans to slow down interest rates, it could lead to further demand for safe-haven assets like gold.

In the meantime, the bearish US dollar and weaker market conditions have a positive impact on gold prices as investors tend to turn to GOLD as a hedge against economic uncertainty and inflation. As long as the market remains uncertain, gold prices may continue to rise.

Investor Worries Grow Amid Uncertainty in the Market and Fear of Global Recession

Investors are worried about the possibility of a global recession due to downbeat US data. The mixed US employment report released last Friday failed to calm investors, and the US dollar index is currently at a two-month low. Meanwhile, riskier assets are losing their appeal, and investors are rushing toward the safety of less risky assets like GOLD .

Moving forward, investors will keep their eyes on the upcoming Federal Open Market Committee (FOMC) Monetary Policy Meeting Minutes and the US Consumer Price Index (CPI) figures.

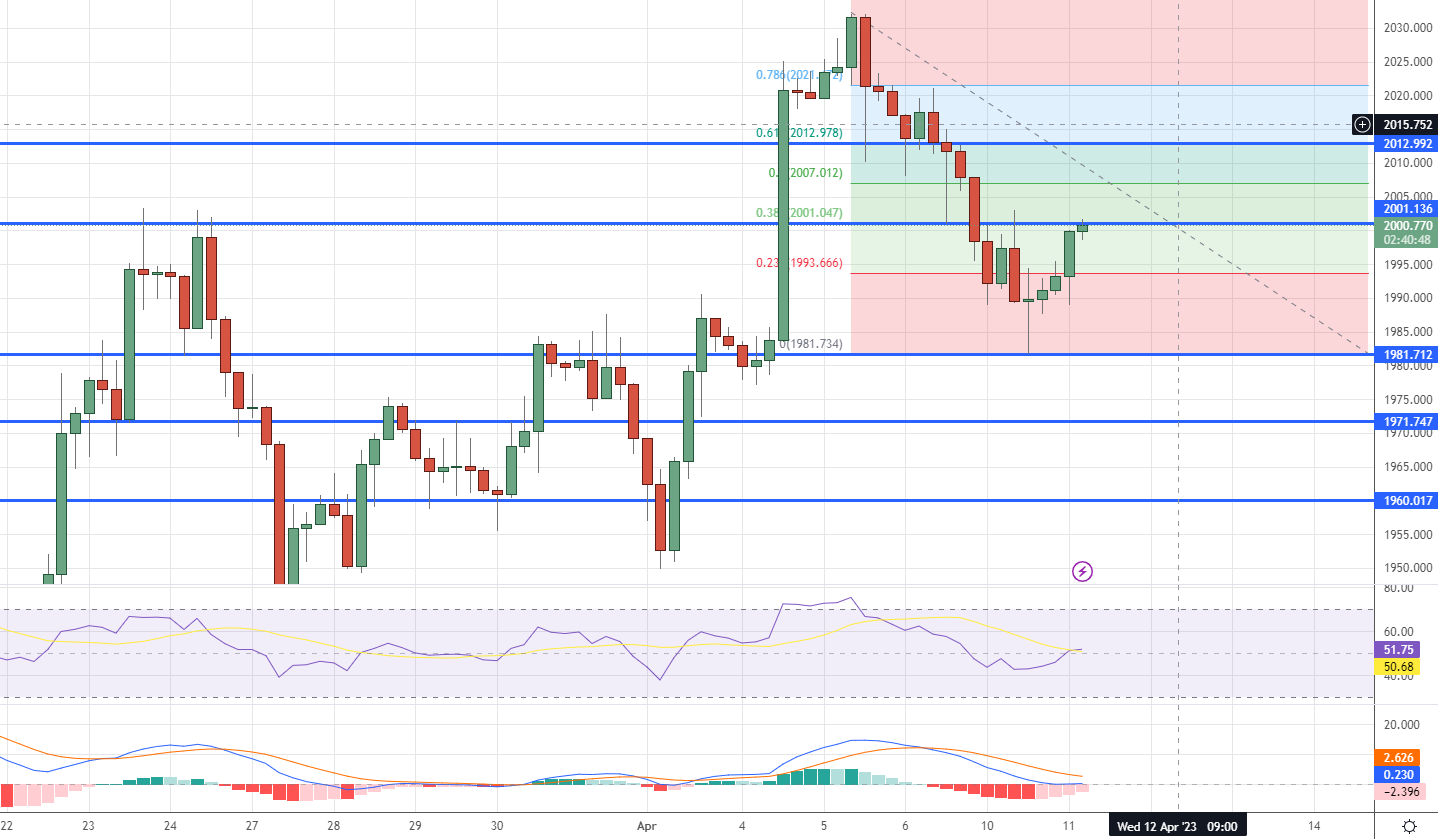

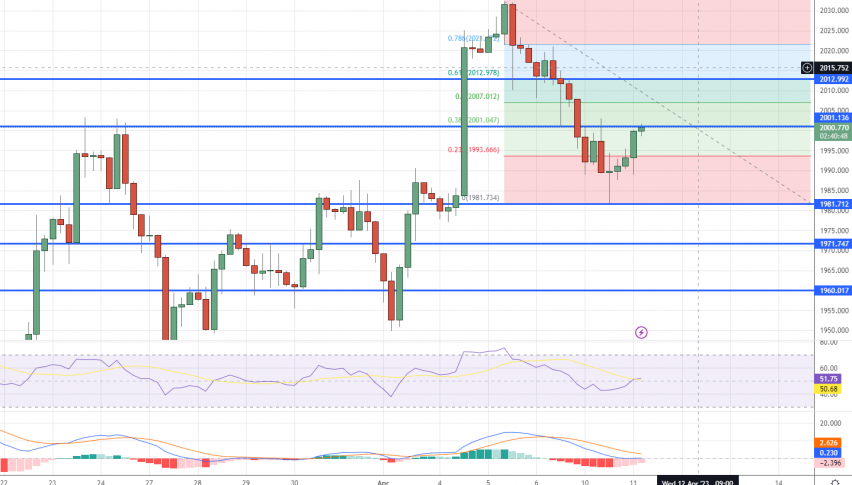

Gold Technical Outlook

The drop in GOLD prices has been halted at the support line of the bullish channel. Currently, the price is attempting to break away from this support and resume its main bullish trend, with the next major targets at the $2010.00 and $2040.00 levels. The technical indicators are giving positive signals, supporting the expected bullish trend, and a break below $1985.00 could trigger a short-term bearish correction before the price turns back up.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account