EUR/USD at Risk: Eurozone Manufacturing Still in Severe Contraction, Targeting 1.10 Sell

Throughout this year, the global manufacturing sector has displayed significant weakness, particularly in the Eurozone, where the activity has been in recession. The latest report from HCOB’s purchasing managers’ index survey for June revealed a further deterioration in the manufacturing sector within the region.

The Eurozone Manufacturing Purchasing Managers’ Index (PMI) dropped to 43.6 points, falling short of market expectations set at 44.7 points and also lower than the May figure of 44.8. This reading represents a 3-year low for the index. Moreover, the HCOB Eurozone PMI Composite, which considers both manufacturing and services sectors, declined to 50.3 points in June, slightly above contraction levels. This result was in contrast to market expectations of 52.5 points and the previous figure of 52.8 points, and it marks a five-month low.

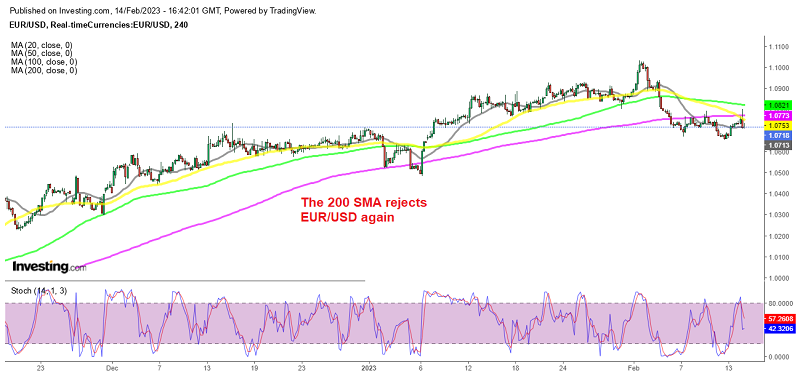

These results indicate a weaker-than-expected performance in the Eurozone manufacturing sector, raising concerns about the overall economic outlook for the region. Today’s final manufacturing reading for June from the Eurozone also confirmed the sector’s weakness. On Friday, EUR/USD saw a notable increase of around 100 pips, mainly driven by USD weakness, as core PCE prices showed another decline, indicating falling inflation in the US. However, given the further slowdown in the Eurozone economy, the downtrend in the EUR/USD pair is likely to resume.

Here are the key figures from the Eurozone Final Manufacturing Reading for June:

- June final manufacturing PMI: 43.4 (preliminary: 43.6)

May manufacturing PMI: 44.8

- The manufacturing output index fell to an eight-month low due to subdued demand conditions. Notably, manufacturing employment experienced a decline for the first time since January 2021, and business confidence dipped to a seven-month low. HCOB highlights the following points:

“Eurozone manufacturing production contracted for the third consecutive month in June, according to the PMI output index, with the rate of decline accelerating and indicating worsening factory conditions. New orders also fell at a faster rate, further increasing the likelihood of a drop in industrial production during the second quarter, after it had contracted by 0.9% month-on-month in the first quarter according to Eurostat.

“The capital-intensive industrial sector appears to be reacting negatively to the ECB’s interest rate hikes. Surveyed companies reduced their workforce for the first time since January 2021, and purchasing activity declined at one of the worst rates on record. Given the weakness in demand and rapid rate of cost deflation, it is not surprising that sales prices have been cut for the second consecutive month.

“The downturn is evident across all major eurozone countries, as all four of them remained in contraction in June. Germany showed the most pronounced weakness in new orders, followed by Italy and France.

“While delivery times seem to be normalizing since February, with companies in the currency union receiving their goods more quickly, material shortages remain a lingering issue. For example, around 28% of companies in the eurozone reported a shortage of materials in the second quarter, compared to an average of just under 7% in 2019, according to DG ECFIN.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account