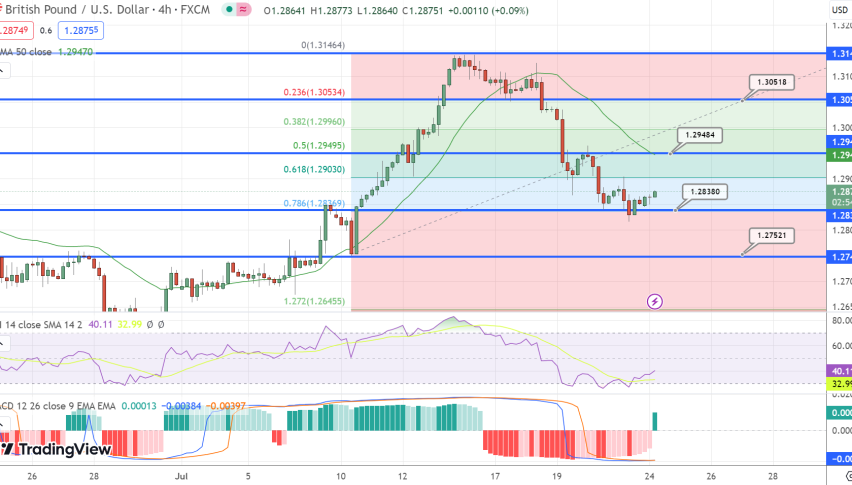

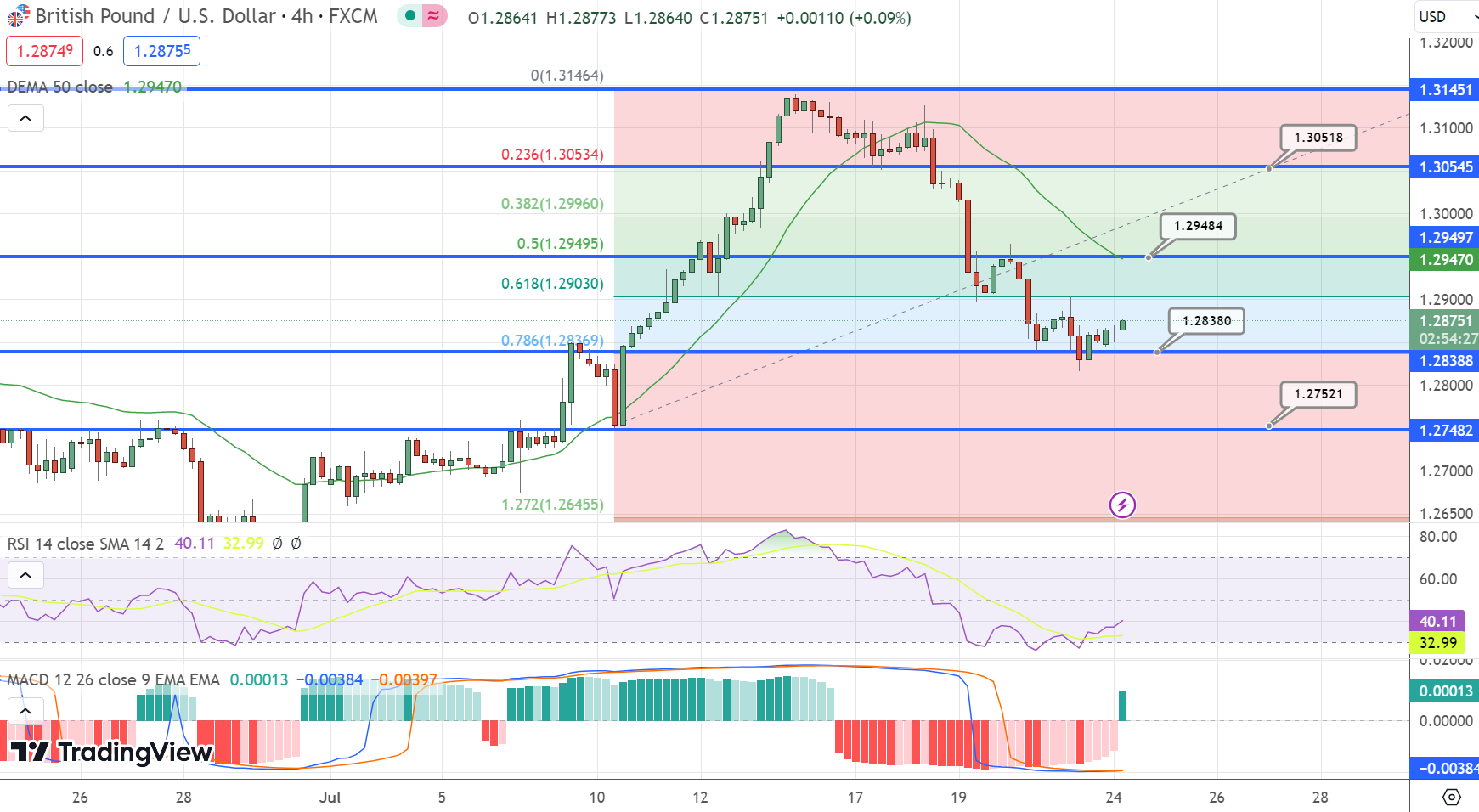

GBP/USD Rebounds From 1.2815 Amidst Cautious Market Sentiment Ahead of FOMC Meeting

The GBP/USD pair experiences a bounce from the 1.2815 level on Monday, currently trading around 1.2860 in the early Asian session.

•

Last updated: Monday, July 24, 2023

The GBP/USD pair experiences a bounce from the 1.2815 level on Monday, currently trading around 1.2860 in the early Asian session. Investors are showing caution and opting to stay on the sidelines in anticipation of the crucial Federal Open Market Committee (FOMC) meeting on Wednesday.

Recent data from the Office for National Statistics (ONS) indicates that UK monthly Retail Sales rose 0.7% in June, surpassing the 0.1% figure in May and exceeding expectations of 0.2%. Meanwhile, the annual Retail Sales data contracted by 1.0%, outperforming the expected -1.5% and the previous -2.1%. Additionally, the monthly headline Consumer Price Index expanded by 0.1%, falling short of the consensus of 0.4% and the previous 0.9%.

The Bank of England (BoE) rate hike decision on August 3 has left investors divided. While some market participants expected BoE Governor Andrew Bailey to raise interest rates by 50 basis points (bps), softer inflation data has led a group of investors to lean towards a 25 bps rate hike.

Regarding the US Dollar, Unemployment Claims came in below expectations, reaching the lowest reading since mid-May. Despite mixed findings from the US Retail Sales figure, this data has raised market anticipation for future Fed tightening policies. As a result, the market has priced in a 25 basis point rate (bps) hike for the upcoming meeting. Furthermore, investors are reevaluating the possibility of another Fed rate increase following the July meeting, leading to a rebound of the Greenback. According to the CME FedWatch Tool, the likelihood of the Fed raising rates after the July meeting has increased to 28% from 15.9% last month.

Later in the day, market focus will shift to the UK Flash Manufacturing and Service PMI. However, the primary attention remains on the upcoming FOMC meeting on Wednesday. A hawkish stance from the Fed could weigh on GBP/USD ahead of the BoE meeting scheduled for August 3.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.