In-Depth Analysis: EUR/USD Pair Amid Anticipation for Eurozone PMI Data and US Economic Indicators

During the early hours of the Asian session on Thursday, the EUR/USD pair recorded slight losses, hovering around 1.0888, marking a marginal 0.01% increase from the previous day.

During the early hours of the Asian session on Thursday, the EUR/USD pair recorded slight losses, hovering around 1.0888, marking a marginal 0.01% increase from the previous day. The focus of investors is now shifting towards the impending release of the Eurozone PMI data set for later in the day. Expectations are set for an uptick in the Eurozone Manufacturing PMI to 43.4, the Services PMI to 48.1, and the Composite PMI to 46.8. Trading activities are subdued in anticipation of the Thanksgiving Day holiday in the United States.

On Wednesday, Joachim Nagel, President of the Bundesbank, commented that interest rates within the Eurozone are nearing their zenith. He stressed that future economic indicators would be critical in determining the necessity for additional tightening measures. In parallel, Luis de Guindos, Vice President of the European Central Bank (ECB), remarked that it is too early to contemplate rate reductions, underscoring the ECB’s reliance on data and clarity in policy communication.

In terms of the US Dollar, recent data revealed a significant drop in the US Jobless Claims for the week ending November 17, falling unexpectedly to 209K, the sharpest decrease since June. Continuing Claims also saw a decline to 1.84M, down from 1.862M. Furthermore, the University of Michigan’s one-year inflation expectations rose marginally to 4.5%, with five-year expectations holding steady at 3.2%.

The University of Michigan Consumer Sentiment Index increased to 61.3 in November, marking its fourth consecutive monthly decrease. This array of data lent some support to the US Dollar, subsequently imposing downward pressure on the EUR/USD pair.

Market participants are now gearing up for the release of the Eurozone preliminary HCOB PMI data for November, scheduled for Thursday, along with the anticipated publication of the minutes from the ECB’s latest meeting. While the US markets will be closed for the Thanksgiving holiday, focus will soon shift to the US S&P Global PMI data due on Friday, which is expected to provide further clarity on the direction of the EUR/USD pair.

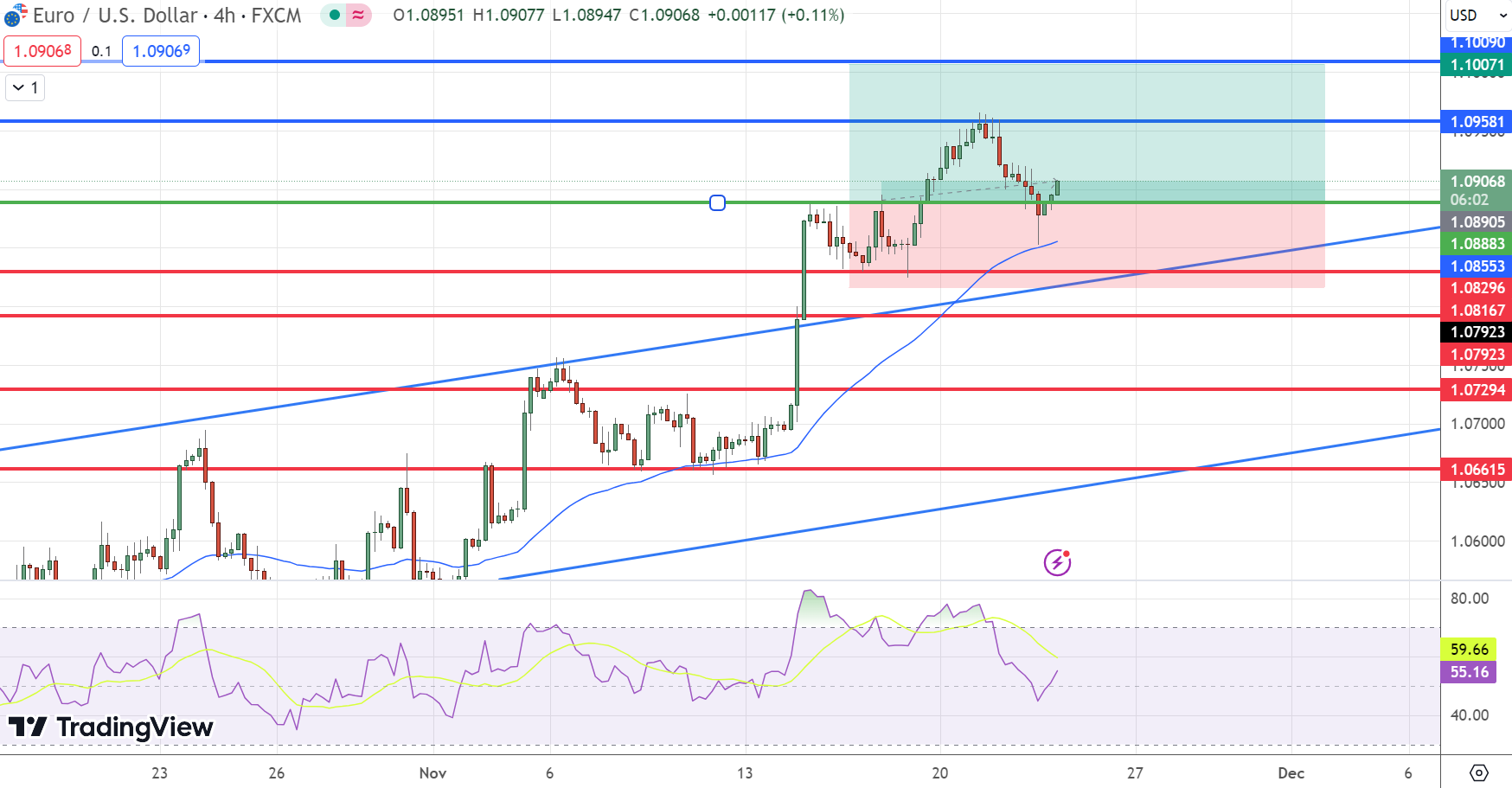

EUR/USD Technical Outlook

The EUR/USD pair recently demonstrated resilience at the 1.0860 support level, rebounding with a bullish momentum that sustains the intraday bullish trend. This trend is eyeing the 1.0960 level as its immediate target, with a breach potentially leading towards the 1.1080 mark.

Technical indicators are aligning in favor of this anticipated rise, which will remain the predominant scenario unless the pair breaks below the 1.0860 threshold and sustains a daily close beneath it.

The trading range projected for today is anticipated to lie between the 1.0860 support level and the 1.1000 resistance level, with the trend expected to lean bullish.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account