EUR/USD Outlook: Positive Trajectory Above 1.0900 Amid Key Economic Data Releases

In the early hours of the Asian trading session on Friday, the EUR/USD pair maintained a positive stance, trading above the 1.0900 mark.

In the early hours of the Asian trading session on Friday, the EUR/USD pair maintained a positive stance, trading above the 1.0900 mark. This upswing in the Euro is driven by unexpectedly strong Eurozone PMI figures. Investors are now turning their focus towards the upcoming release of Germany’s Q3 Gross Domestic Product data and the US PMI statistics. Currently, the EUR/USD has risen by 0.03%, standing at 1.0909.

Thursday’s preliminary PMI data from the Eurozone surpassed forecasts. The Composite PMI increased to 47.1, up from 46.5, exceeding the predicted 46.9. Additionally, the Manufacturing PMI reached a six-month peak at 43.8, compared to the previous 43.1, and the Services PMI also improved to 48.2 from 47.8. As a result, the Euro has strengthened against the US dollar.

The US markets remained closed on Thursday, leading to a lack of economic data releases. However, expectations that the Federal Reserve may conclude its rate-hiking cycle and potentially reduce rates by mid-2024 have weakened the US dollar. The forthcoming US PMI data is anticipated to provide insights into the country’s economic health, with predictions of a slight decrease in both Manufacturing and Services PMI.

Looking ahead, market watchers will closely follow the German Q3 GDP, the IFO Survey, and a speech by ECB President Christine Lagarde on Friday. During the American session, the release of the US S&P Global PMI data is also scheduled. These economic indicators are expected to provide significant guidance for trading strategies around the EUR/USD pair.

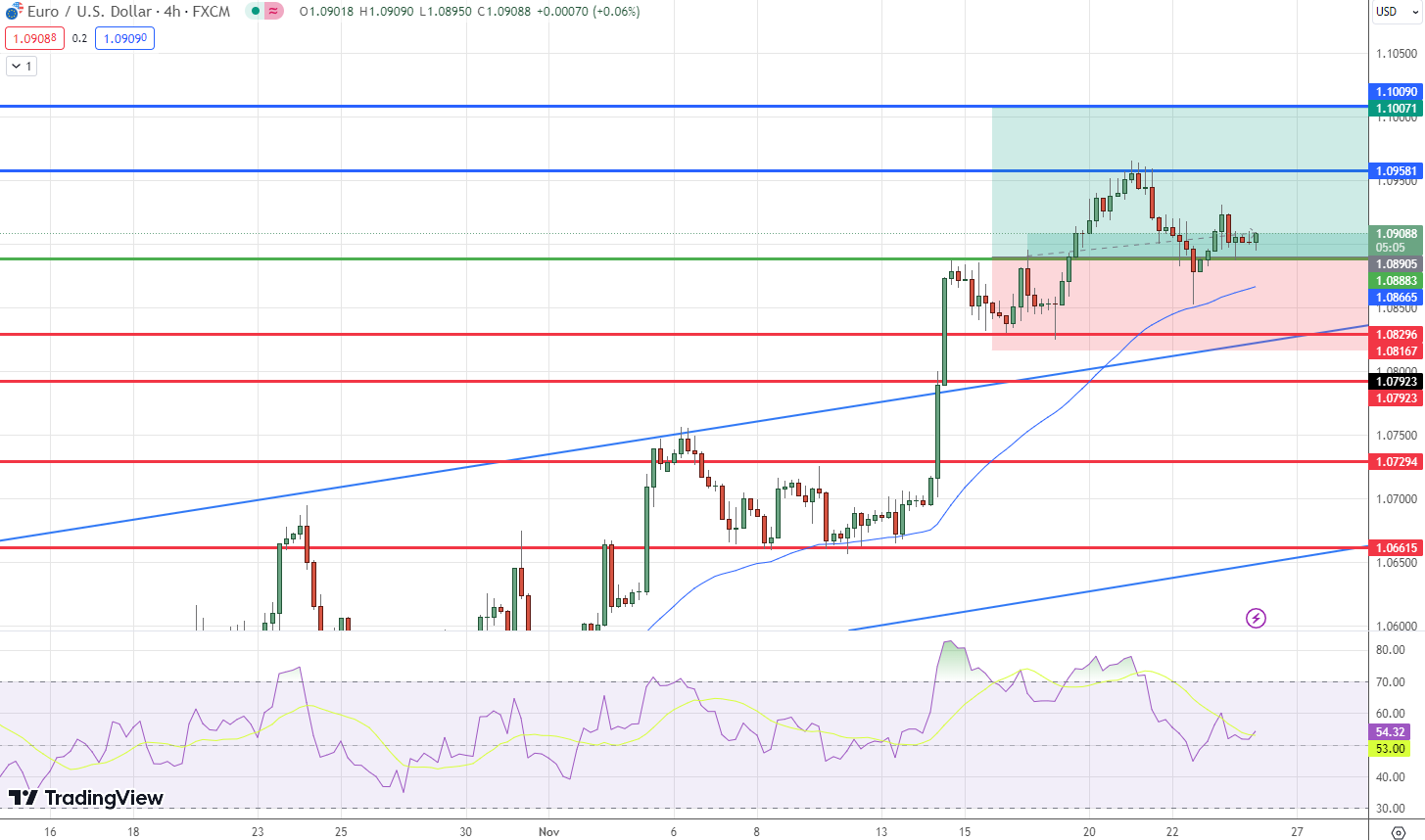

In technical terms, the EUR/USD pair is experiencing slight fluctuations, with the stochastic indicator moving out of negative momentum towards oversold areas. This change suggests a potential impetus for a continued bullish trend in the intraday, with initial targets around the 1.0960 level. Breaching this level could further propel the bullish trend towards 1.1080.

In technical terms, the EUR/USD pair is experiencing slight fluctuations, with the stochastic indicator moving out of negative momentum towards oversold areas. This change suggests a potential impetus for a continued bullish trend in the intraday, with initial targets around the 1.0960 level. Breaching this level could further propel the bullish trend towards 1.1080.

Conversely, it’s important to consider that a break below the 1.0860 mark could halt this positive outlook, leading to a downward trend. The trading range for the day is projected between the support level of 1.0830 and resistance at 1.0980, with the overall trend expected to be bullish.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account