USD/CAD Faces Hurdles Amid BoC’s Rate Cut Prospects and USD Strength

The USD/CAD pair is exhibiting difficulty in building upon its recent rebound from the mid-1.3300s, a three-month nadir, maintaining a slightly negative stance just under the 1.3400 level during Tuesday's Asian session.

The USD/CAD pair is exhibiting difficulty in building upon its recent rebound from the mid-1.3300s, a three-month nadir, maintaining a slightly negative stance just under the 1.3400 level during Tuesday’s Asian session.

The pair’s downside is somewhat mitigated following Bank of Canada (BoC) Governor Tiff Macklem’s dovish comments. Macklem hinted at possible rate cuts in 2024, leading to market anticipations of policy easing as early as April, with an expected total rate reduction of 100 basis points by year-end.

This scenario could provide a boost to the USD/CAD pair, notwithstanding the recent uptick in Crude Oil prices, which generally favors the commodity-sensitive Canadian Dollar (Loonie).

Additionally, a slight rise in the US Dollar (USD) is set to underpin the pair and curb any downward trends. Statements from Chicago Fed President Austan Goolsbee and Cleveland Fed President Loretta Mester countered market expectations for early rate cuts, following similar sentiments from New York Fed President John Williams. T

hese developments, coupled with geopolitical risks, enhance the USD’s status as a relative safe-haven against the Canadian Dollar.

Market participants are currently hesitant to make bold directional moves with the USD/CAD pair, opting to await Canada’s latest consumer inflation data for new momentum during the North American trading session.

The US economic calendar includes housing market data – Building Permits and Housing Starts – and a scheduled speech by Richmond Fed President Thomas Barkin. These factors, along with Oil price movements, are likely to create short-term trading scenarios.

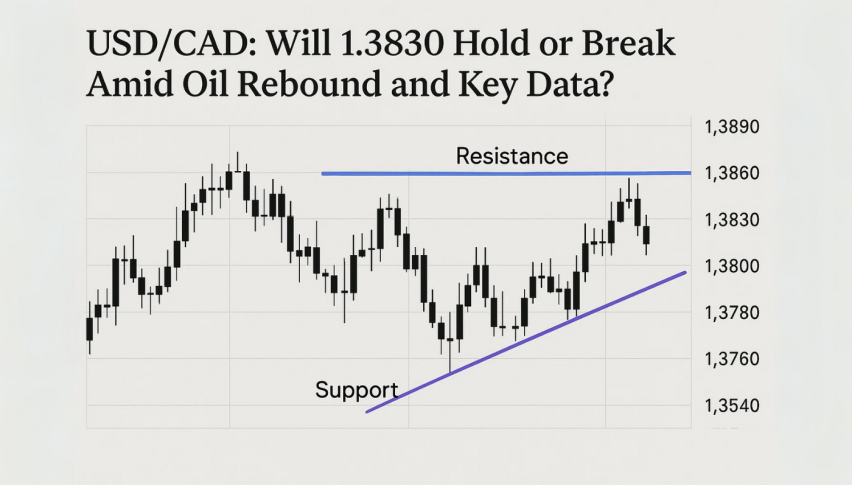

USD/CAD Technical Outlook

The USD/CAD pair finds robust support near 1.3350, displaying a tentative bullish tilt to test the 1.3400 barrier. However, overbought signals from the stochastic oscillator suggest the potential for a resumption of bearish trends, with initial targets set at a break below 1.3350 and a subsequent move towards 1.3255.

The bearish outlook remains favoured, though a breach of 1.3420 could halt this decline, leading to further gains towards the 1.3500 mark.

Today’s expected trading range is between 1.3310 support and 1.3440 resistance, with the trend leaning towards bearish.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account