What You Need to Know Before Buying Aptos (APT)

Aptos (APT), the high-speed Layer 1 blockchain launched in October 2022, has garnered significant attention recently due to its innovative

•

Last updated: Thursday, February 1, 2024

Aptos (APT), the high-speed Layer 1 blockchain launched in October 2022, has garnered significant attention recently due to its innovative technology, strategic partnerships, and volatile price swings. This article delves into Aptos’ latest developments, explores its potential as an investment, and provides a technical analysis for traders.

Recent Developments in the Aptos Ecosystem

- Hackathon Frenzy: Aptos kicked off February with its first global hackathon in Seoul, attracting developers to build on its platform. This signals their commitment to fostering a vibrant developer community.

- Growing Ecosystem: Aptos Labs announced partnerships with several projects, including Pontem Network, Aptos Name Service, and the Petaverse, expanding its DeFi, NFT, and metaverse offerings.

- Binance Backing: Aptos’ inclusion in Binance’s Web3 Recovery Initiative program provided crucial support during the market downturn, highlighting its potential.

Aptos (APT) Investment Potential

- Technological Prowess: Aptos boasts a novel transaction processing system, promising high scalability and low latency, positioning it well for future growth in DeFi and Web3 applications.

- Strong Backing: Renowned investors like Andreessen Horowitz and FTX Ventures back Aptos, indicating confidence in its long-term vision.

- Early Adopter Advantage: Investing in a promising project early can offer significant returns if it gains mainstream adoption.

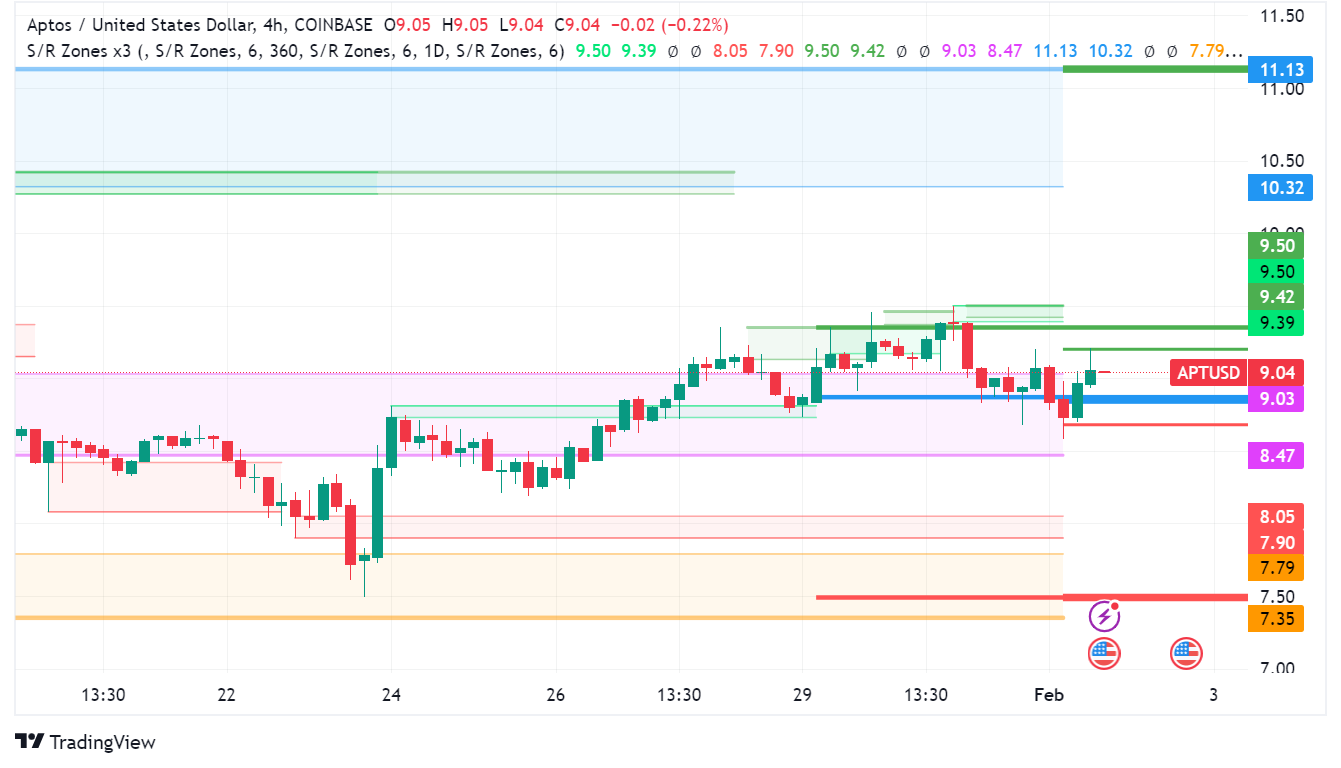

APT/USD Technical Analysis

- Current Price: $9.05

- Recent Trend: Downward, with some short-term recoveries.

- Support Levels: $7.50, $6.50, $5.00

- Resistance Levels: $9.00, $10.00, $12.00

- Moving Averages: Suggest a downtrend, but recent consolidation indicates potential reversal.

- Indicators: Mixed signals, with some suggesting oversold conditions and others pointing to continued decline.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.