Brazil: Jump in inflation forecasts for 2025 and 2025

The survey, which captures market perception for economic indicators, indicated that the expectation for the increase in the CPI.

Brazil: Jump in inflation forecasts for 2024 and 2025

Analysts consulted by the Central Bank made small upward adjustments to their projections for inflation this year and next.

The survey, which captures market perception for economic indicators, indicated that the expectation for the increase in the IPCA (National Consumer Price Index).

The official inflation target center for 2024, 2025, and 2026 is 3%, with a tolerance margin of 1.5 percentage points up or down. Data released last week showed that inflation in Brazil slowed down in January to 0.42%, but it remained above expectations, raising concerns about the weight of food and services prices.

The weekly survey of a hundred economists also showed that there were no changes in the outlook for the basic interest rate, with the Selic rate again calculated at 9% in 2024 and 8.5% in 2025. Currently, it stands at 11.25%, and the market expects a further 0.5 percentage point cut at the Copom (Monetary Policy Committee) meeting in March, as indicated by the Central Bank.

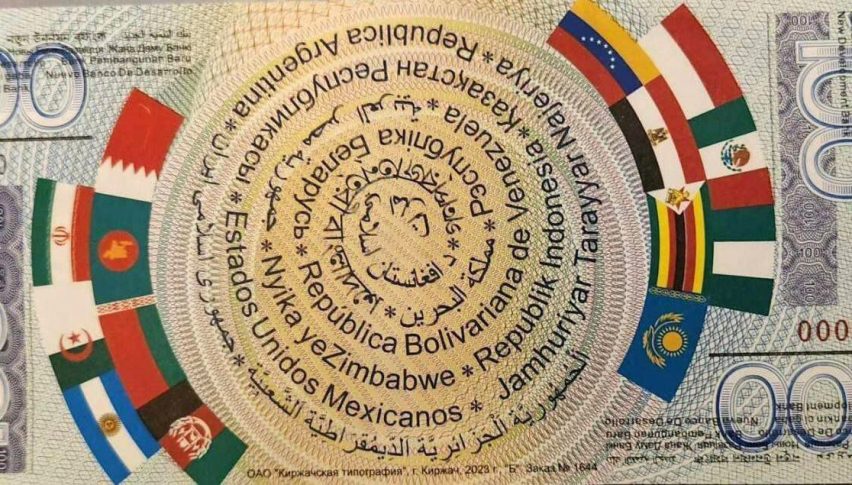

México and Brazil maintain the highest premium above Treasury bonds, the so-called carry trade, among Latin American emerging markets.

The measured premium in dollars is approximately 5% in both cases. This represents one of the highest real rates in recent decades. Since the 2008 international financial crisis, such competitive rates haven’t been observed.

The survey, which captures market perception for economic indicators, indicated that the expectation for the increase in the IPCA (National Consumer Price Index) rose by 0.01 percentage points for both 2024 and 2025, reaching 3.82% and 3.51%, respectively.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account