State-owned oil companies in LATAM rise nearly 3% due to the increase in oil prices

Petrobras and EcoPetrol, the state-owned oil companies in LATAM, rose nearly 3% due to the increase in oil prices.

State-owned oil companies in LATAM rose nearly 3% due to the increase in oil prices

Petrobras and EcoPetrol, the state-owned oil companies in LATAM, rose nearly 3% due to the increase in oil prices.

Today, the price of oil rose by more than 2%, leading to a corresponding increase of the same magnitude in state-owned oil companies in LATAM. Among them, Petrobras, owned by the Brazilian government, and Ecopetrol, owned by the Colombian government, stood out.

Meanwhile, Yacimientos Petrolíferos Fiscales (YPF), owned by the Argentine government, did not experience significant variations and ended Thursday’s session with a slight decrease of 0.1%. The price of Brent crude oil settled at $83 per barrel.

The variations of this week may be explained by EIA Crude oil inventories data. Crude inventory for the last week showed a significant build of 12,018K barrels, well above the expected increase of 2,560K barrels. This marked a substantial rise from the previous reading of 5,521K barrels.

Gasoline inventories experienced a drawdown of 3,658K barrels, surpassing the anticipated decrease of 1,160K barrels. Distillates also saw a drawdown, albeit slightly smaller than expected, at 1,915K barrels compared to the forecasted decline of 1,600K barrels. Refinery utilization fell by 1.8%, contrasting with the expected increase of 2.6%.

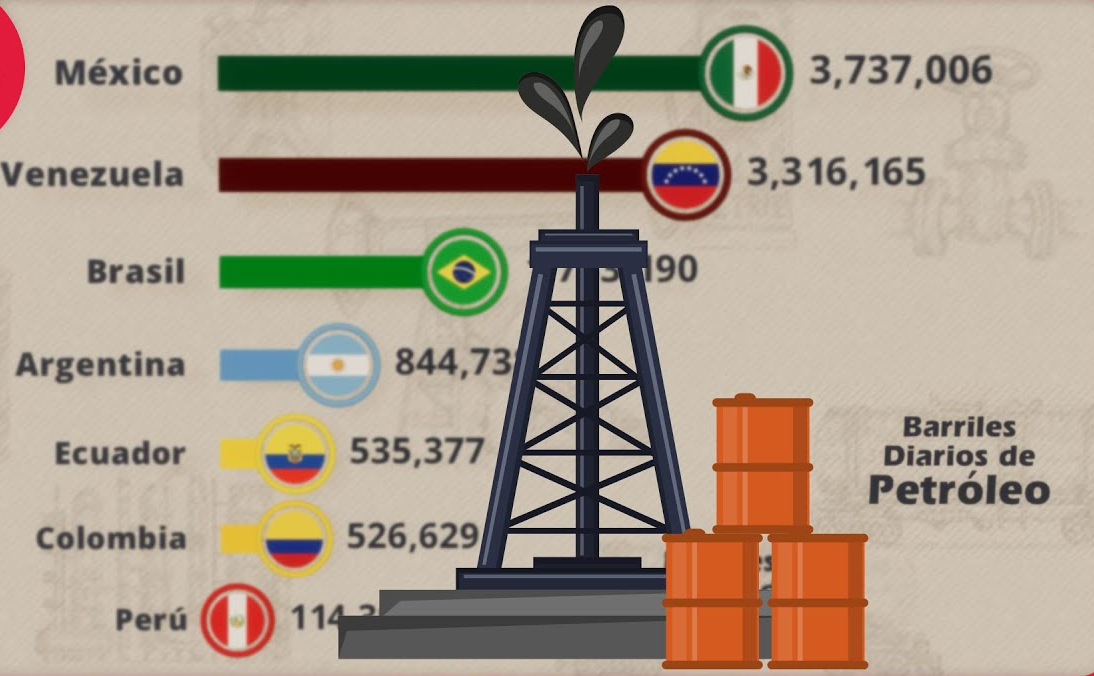

- Brazil

- Venezuela

- Mexico

- Colombia

- Argentina

The price of oil holds immense importance for both Colombia and Brazil as it directly influences their economies, fiscal policies, and overall stability. In Colombia, oil exports represent a significant portion of government revenues and GDP, funding crucial public services and infrastructure projects.

Fluctuations in oil prices profoundly impact Colombia’s fiscal balance, with high prices driving economic growth and low prices resulting in revenue shortfalls and budget deficits. Similarly, Brazil heavily relies on oil revenues, particularly from Petrobras, to support government programs and drive economic development

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account