The fight against inflation “isn’t over” says the President of the CB of Brazil

Roberto Campos Neto emphasizes that "the job is not done and risks remain ahead." The market worries about a pivot toward slower rate cuts.

Roberto Campos Neto emphasizes that “the job is not done and risks remain ahead.” The market worries about a pivot toward slower rate cuts.

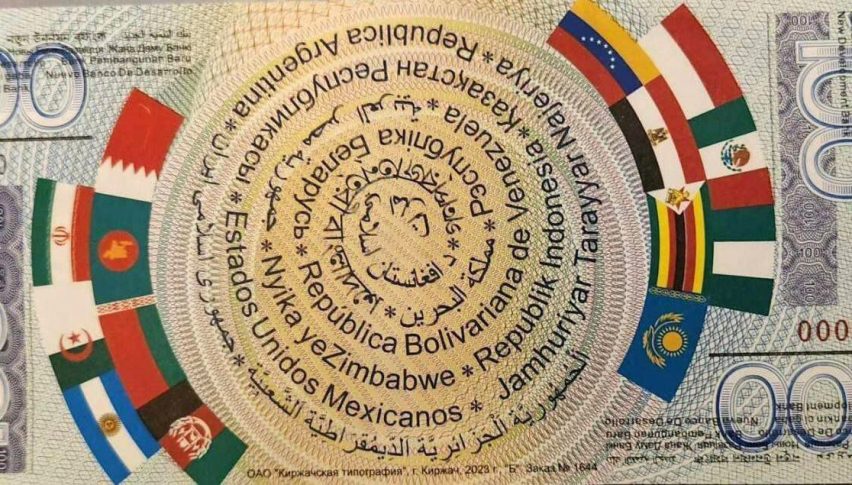

During the opening of the meeting between finance ministers and central bank presidents of the G20 in São Paulo, the President of the Central Bank, Roberto Campos Neto, stated that the work of controlling inflation is not yet done. According to him, there is still a “last mile” missing, and risks lie ahead.

Campos Neto assessed that “when we look at global sovereign debt, we have reached very high levels after the pandemic.” He believes that “the cost of servicing debt will be high, and therefore, we will have less liquidity for emerging markets and low-income countries.”

He also mentioned that developing countries need to “bear the costs of the green transition and geopolitical reorganizations.”

Regarding the meeting’s theme, Campos Neto emphasized that “sound macroeconomic policies support an environment where long-term growth can be sustained, and social disparities can be reduced.”

According to the Brazilian authority, “central banks have ensured that they will remain strongly committed to achieving price stability in line with their respective mandates.”

Campos Neto highlighted “many pieces of evidence that inflation has a negative impact on poverty levels, disproportionately harming the most vulnerable, deepening existing social disparities and inequalities.”

The President of the Central Bank recalled that “during the pandemic, central banks and governments acted in a coordinated manner to sustain economic activity and keep inflation under control.”

In the current scenario, “following the synchronized action of central banks, we have made progress in reducing inflation, but this process is not yet finished.”

Campos Neto concluded by stating that “under Brazil’s presidency of the G20, financial inclusion will be a central pillar to promote development and reduce inequality.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account