U.S. GDP Jumps Slightly Less Than Previously Estimated In Q4

Revised data released by the Commerce Department on Wednesday showed the U.S. economy grew by slightly less than previously estimated in the fourth quarter of 2023. The Commerce Department said the j...

Revised data released by the Commerce Department on Wednesday showed the U.S. economy grew by slightly less than previously estimated in the fourth quarter of 2023.

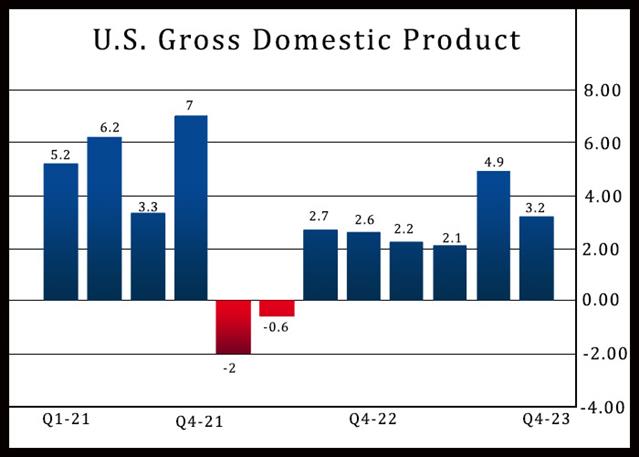

The Commerce Department said the jump by real gross domestic product in the fourth quarter was downwardly revised to 3.2 percent from the previously reported 3.3 percent. Economists had expected the surge in GDP to be unrevised.

The slightly slower than previously estimated growth reflected downward revisions to private inventory investment and federal government spending as well as an upward revision to imports, which are a subtraction in the calculation of GDP.

Meanwhile, the report also showed upward revisions to state and local government spending, consumer spending, residential fixed investment, nonresidential fixed investment and exports.

“For once the data came in a little softer than expected – although it is just a slight adjustment down to 3.2% GDP growth from 3.3% GDP growth – but it’s possible that even a slight trend toward less-hot-than-expected can be seen as a welcome development,” said Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance.

He added, “It is only in the topsy-turvy world of Wall Street where bad news can be good news (e.g. lower economic growth is good) because of the interplay between the economy, markets and the Federal Reserve.”

The downwardly revised GDP growth in the fourth quarter reflects a substantial slowdown compared to the 4.9 percent surge in the third quarter.

The Commerce Department said the slower GDP growth in the fourth quarter primarily reflected a downturn in private inventory investment and slowdowns in federal government spending, residential fixed investment, and consumer spending.

GDP growth in the fourth quarter remained significantly strong, however, reflecting increases in consumer spending, exports, state and local government spending, nonresidential fixed investment, federal government spending, and residential fixed investment.

On the inflation front, the report said the increase in consumer prices in the fourth quarter was upwardly revised to 1.8 percent from 1.7 percent, while the increase in core prices, which exclude food and energy prices, was upwardly revised to 2.1 percent from 2.0 percent.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account