USDJPY – No Technical Recession For Japan, When Will the BoJ Hike?

The main development for the Japanese Yen is the possible hike with is pending. The Bank of Japan will be the only member of the G7 group which will be hiking interest rates in 2024. The remaining six are likely to cut interest rates in the summer months depending on inflation. However, investor should also take into consideration the indirect correlation between the Dollar and Yen. This is due to their status as safe haven currencies. Japan has the second highest currency reverses in the world and makes up almost 9% of traded currencies. The Bank of Japan have not hiked interest rates since 2007.

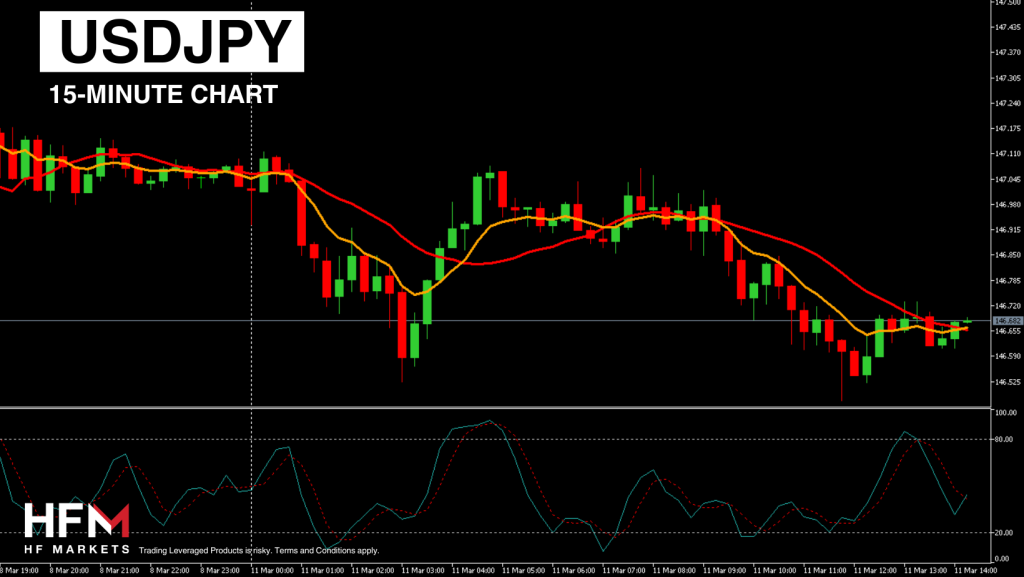

The Japanese Yen is not seeing major volatility within this morning’s Asian session and European session but is seeing some gains against the Dollar. The Yen is trading slightly higher than the day’s market price, but investors will monitor any change in momentum. Previously, the preliminary economic growth data indicated that the Japanese economy has slipped into a recession. However, the GDP rate read 0.1% which confirms “no recession”. Therefore, economists are continuing to predict the Bank of Japan will keep interest rate hikes as an option for the next two meetings.

Households are minimizing spending amid the economic crisis and rising inflation, which could negatively affect the national economy, which entered a recession at the end of last year. Despite this, the Bank of Japan is considering abandoning the current loose monetary policy after negotiations between the management of national companies and trade unions on adjusting employee wages, which increases the consumer price index against demand growth.

The market is implying a 53% chance the Bank of Japan will shift rates to zero at its meeting on March 19th. However, some analysts still believe it might be at April’s meeting. However, the currency is likely to grow for as long as the Japanese economy does not fall into a “technical recession” and other competitors continue with rate cuts.

Investors are pondering why the USDJPY isn’t experiencing a significant and distinct downward price movement. Fundamental analysts suggest that numerous investors are waiting for validation from the monthly inflation data to gauge when the Federal Reserve might “pivot.” Should the yearly inflation rate fail to decrease, the Fed could delay rate hikes. Consequently, the Dollar could persist obstinately. Conversely, a decline in inflation could lead to a rise in the Japanese Yen.

The latest employment figures for the US are as follows:

Average Salary Growth: 0.1% vs 0.2%

Unemployment Rate: 3.9% vs 3.7%

NFP Employment Change: 275,000 vs 195,000

The new employment data for the US originally brought about a decline in the US Dollar, before correcting upwards. The first reaction to sell the Dollar was largely due to data indicating a rate cut by June. The salary growth fell to a level which the regulator is more comfortable with, and the unemployment rate rose to 3.9%. Previously economists were advising the Unemployment Rate will need to reach 4-4.5% to bring inflation down. According to the FedWatch Tool, 58% of traders believe the Fed will cut in June and 25% believe it could be in May.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account