USD/CLP: The Chilean Peso Gets Some Bullish Momentum from Higher Copper & Stock Index

Copper prices jumped over 3% today, and the IPSA stock index reached another ATH boosting demand for the Chilean Peso.

Copper prices jumped over 3% today, and the IPSA stock index reached another ATH boosting demand for the Chilean Peso.

The USD/CLP continued its journey south as the Peso picked up more bullish sentiment driven by a surge in copper prices. To add to the positive sentiment for the Chilean currency the main stock index (IPSA) posted another ATH today, before retreating slightly.

The Peso had been in a bear run since December 2023, but on February 26 the market hit a resistance level marked by a previous high from October 2022. The USD/CLP has been losing ground since, and today’s candle looks like it’s going to break a support line from October 2023.

Tomorrow we are expecting PPI and Retail Sales data for the US. Expectations are for a slightly lower price increase and improved retail sales. The market is watching for sure, but the numbers aren’t important enough to deter the bullish sentiment for the peso, in my opinion.

Tomorrow’s US PPI and Retail data might add some volatility, but unless something game-changing gets published we can expect the peso to continue to strengthen.

Technical View

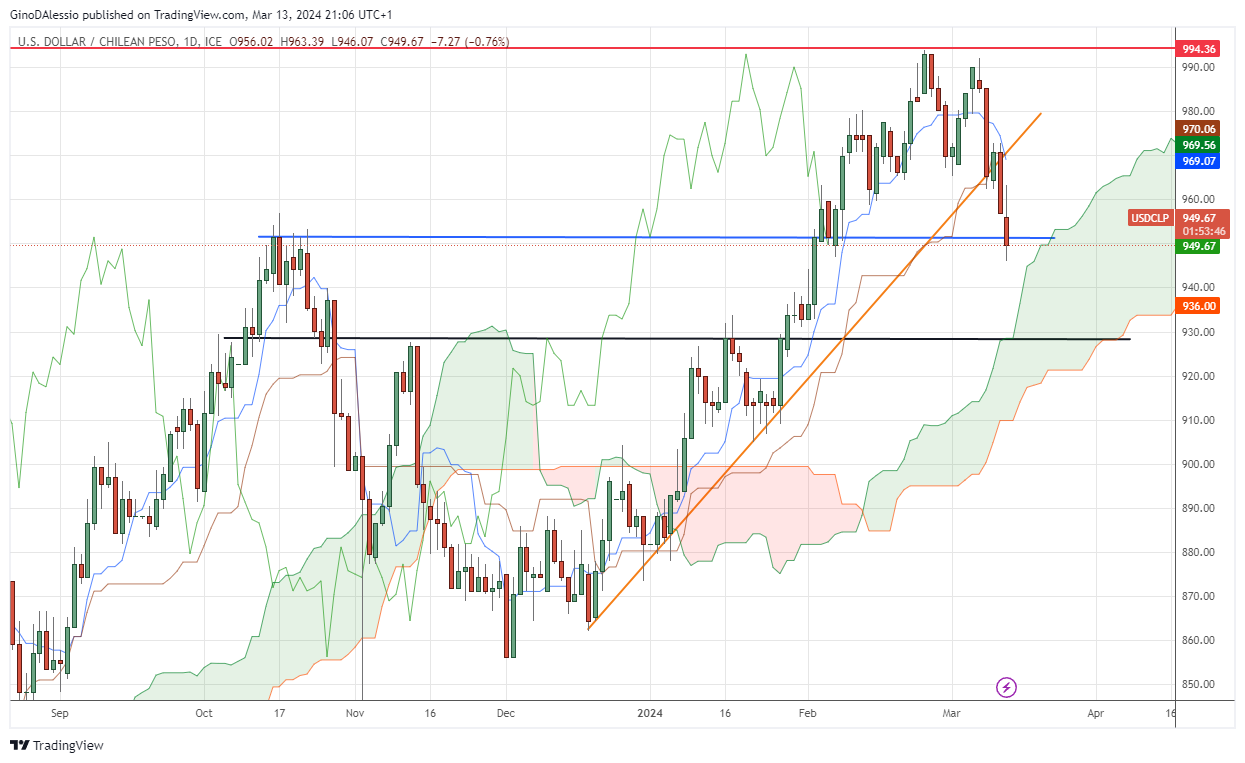

From the day chart below we can see how the market failed to break a major resistance level (red line) and has been retracing over the past 3 weeks. Today’s price action will determine the next move, if the market manages to close below the blue line.

A break below the blue line should open the possibility of further downward pressure on this pair. The market also broke a significant trend line (diagonal orange line) yesterday and adds to the bearish signals on this chart.

However, the market will find solid resistance on the bottom of the cloud. This level also coincides with a support level marked a previous top in October 2023, adding some extra strength.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account