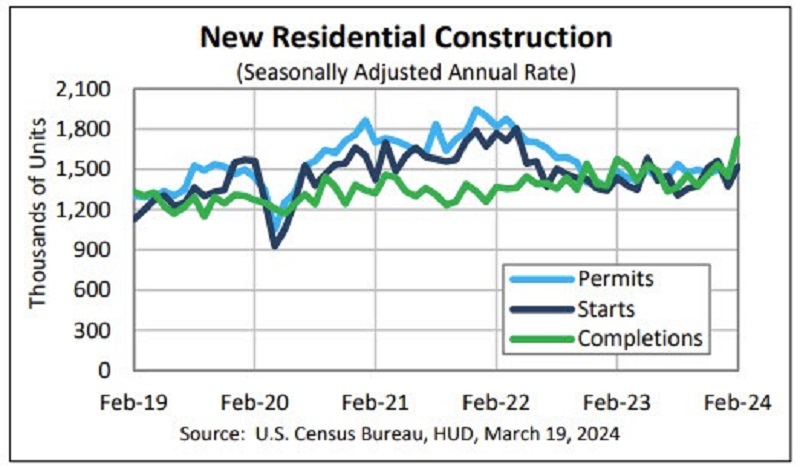

The Last US Data, US Housing Starts and Building Permits Impress

The Housing Starts and Building Permits were the last round of economic data from the US ahead of tomorrow's FED meeting, which jumped up

The Housing Starts and Building Permits were the last round of economic data from the US ahead of tomorrow’s FED meeting, which showed a decent improvement. The FED won’t be swayed by this data, but it shows that the housing sector is recovering after softening for several months, and that the US economy is in decent shape.

US Housing Starts For February

The trend in the housing sector is turning up

The dollar is currently trading at all-time highs, supported by positive market sentiment. In the broader markets, the dollar has received additional support from the bond market in recent weeks. At the start of this week, 10-year Treasury rates have remained elevated, reaching their highest level of the year.

Yields are currently hovering around 4.32%, close to the February peak of 4.35%. This sustained strength in bond yields has contributed to the dollar’s resilience and its ability to maintain its elevated levels. Investors will continue to monitor bond market dynamics closely as they assess the outlook for the dollar and broader market sentiment.

US building permits and housing starts for February 2024

Building Permits:

- Housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,518,000, up 1.9% from the revised January rate of 1,489,000.

- This rate is also 2.4% higher than the February 2023 rate of 1,482,000.

- Single-family authorizations increased to a rate of 1,031,000, up 1.0% from the revised January figure of 1,021,000.

- Authorizations of units in buildings with five units or more were at a rate of 429,000 in February.

Housing Starts:

- Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,521,000, marking a significant 10.7% increase from the revised January estimate of 1,374,000.

- This rate is also 5.9% higher than the February 2023 rate of 1,436,000.

- Single-family housing starts increased to a rate of 1,129,000, up 11.6% from the revised January figure of 1,012,000.

- The rate for units in buildings with five units or more was 377,000 in February.

Housing Completions:

- Privately-owned housing completions in February were at a seasonally adjusted annual rate of 1,729,000, showing a substantial 19.7% increase from the revised January estimate of 1,445,000.

- This rate is 9.6% higher than the February 2023 rate of 1,577,000.

- Single-family housing completions stood at a rate of 1,072,000, up 20.2% from the revised January rate of 892,000.

- For units in buildings with five units or more, the February rate was 644,000.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM