U.S. Pending Home Sales Rebound 1.6% In February, Slightly More Than Expected

After reporting a sharp pullback in U.S. pending home sales in the previous month, the National Association of Realtors released a report on Thursday showing a notable rebound by pending home sales in...

After reporting a sharp pullback in U.S. pending home sales in the previous month, the National Association of Realtors released a report on Thursday showing a notable rebound by pending home sales in the month of February.

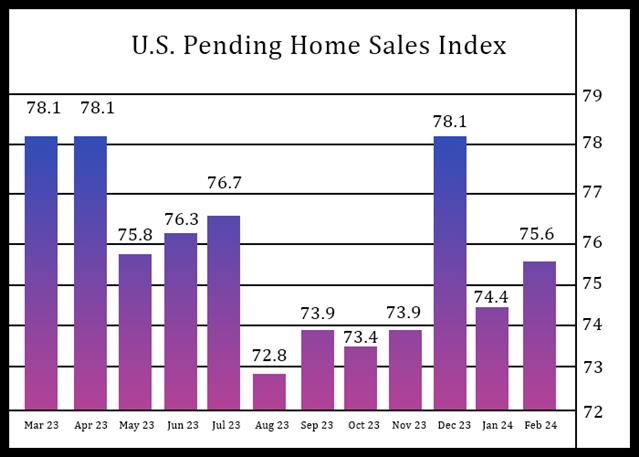

NAR said its pending home sales index shot up by 1.6 percent to 75.6 in February after plunging by 4.7 percent to a revised reading of 74.4 in January.

Economists had expected pending home sales to jump by 1.5 percent compared to the 4.9 percent nosedive originally reported for the previous month.

A pending home sale is one in which a contract was signed but not yet closed. Normally, it takes four to six weeks to close a contracted sale.

“While modest sales growth might not stir excitement, it shows slow and steady progress from the lows of late last year,” said NAR Chief Economist Lawrence Yun. “Ongoing job gains are clearly increasing demand along with more inventory.”

The rebound in pending home sales partly reflected strength in the Midwest, where pending home sales soared by 10.6 percent.

Pending home sales in the South also jumped by 1.1 percent, while pending sales in the Northeast dipped by 0.3 percent and pending sales in the West tumbled by 6.5 percent.

“The high-cost regions in the Northeast and West experienced pullbacks due to affordability challenges,” said Yun. “Home prices rising faster than income growth is not healthy and adds challenges for first-time buyers.”

On Monday, the Commerce Department released a separate report showing new home sales in the U.S. unexpectedly decreased in the month of February.

The Commerce Department said new home sales dipped by 0.3 percent to an annual rate of 662,000 in February after jumping by 1.7 percent to a revised rate of 664,000 in January.

Economists had expected new home sales to surge by 2.9 percent to a rate of 680,000 from the 661,000 originally reported for the previous month.

Despite the monthly pullback, new home sales in February were still up by 5.9 percent compared to the same month a year ago.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account