Brazil: Intervention “had nothing to do with currency movement,” says CB president.

Yesterday the CB clearly intervened. Traders were concerned about the possibility of a more aggresive stance from now on.

The President of the Central Bank (BC), Roberto Campos Neto, stated that the currency intervention carried out by the BC last Tuesday had “nothing to do with the currency movement.” Campos Neto participated in the Bradesco BBI Brazil Investment Forum on Wednesday 3rd.

Traders were concerned about the possibility of a more aggresive stance from now on. Campos Neto made clear that particular interventions that were seen to restrict the dollar from rising was just a matter of volatility issues once.

“We were observing that there could be dysfunctionality on that day, so an intervention was carried out,” he stated. “We even mentioned this in the intervention text. We understand that the exchange rate is floating, and the Central Bank must intervene when there is dysfunctionality in the currency. If there is any moment of it, we will intervene.”

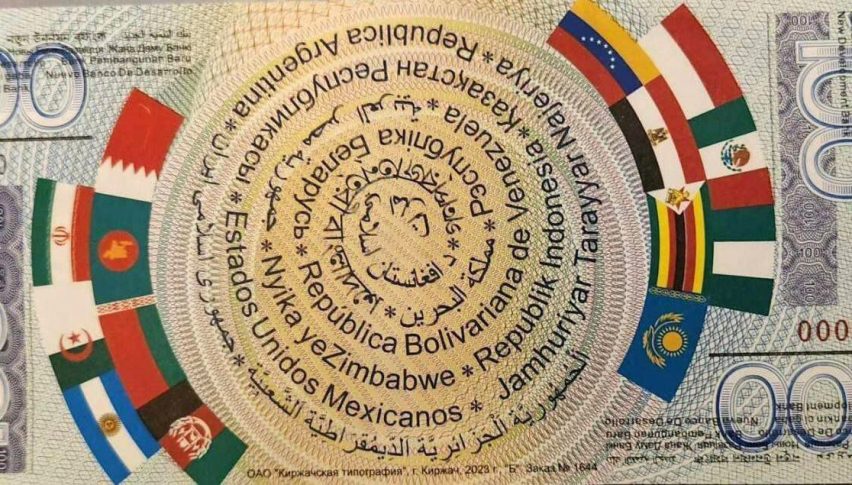

Overall, the President of the Central Bank emphasized that when looking at the behavior of the exchange rate in 2024, the real is “relatively okay” compared to other currencies in the emerging world. Campos Neto pointed out that the country’s external situation is “solid” and that money from the harvest should start coming in. “We have a fairly good reserve situation compared to other countries in Latin America and the emerging world in general. With a strong flow and a reasonable volume of reserves, the exchange rate shouldn’t be a problem in Brazil,” he said.

When asked about the interest rate differential, Campos Neto said that it shouldn’t be a problem yet and that it is quite favorable. However, the President of the Central Bank emphasized that this is a “two-sided equation,” involving remuneration and the risk differential. “If your perceived risk rises with the same interest rate differential, then your currency has to depreciate to compensate. The question is whether there has been any change on the risk side recently or not,” he said.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account