How Long Can The ECB Hold Off A Rate Cut?

Yesterday, the EURUSD experienced a significant bullish surge, standing out among all pairs in terms of price action clarity and strength. This can be attributed largely to the absence of conflicting price conditions. During this period, the Euro gained value against all currencies, while the US Dollar Index notably declined. However, investors should remain mindful of factors indicating ongoing Dollar strength.

A primary concern revolves around the inflation rate in the Eurozone, particularly notable in Germany where inflation has dipped to nearly its lowest level in three years, hovering close to its target. Recent data shows a decrease in inflation from 2.7% to 2.3%, with Core Inflation dropping to 3.3%. Despite elevated energy prices, inflationary pressures persistently wane in Europe. Consequently, economists anticipate a swifter adjustment to interest rates to meet specific targets, such as stimulating economic growth and averting disinflation. Should interest rates indeed decrease, the Euro may face downward pressure similar to the situation in 2022 when the ECB abstained from rate hikes.

The European Central Bank’s interest rate decision is scheduled for the 11th. With no further EU data slated for release in the coming days, investor focus will shift primarily to the US, particularly regarding the potential for Fed rate cuts. The latest release for the US Dollar is the US ADP Non-Farm Employment Change which read higher than expectations. The NFP Employment Change rose from 140,000 to 184,000 and beat expectations. This is known to support the US Dollar, but price action must also indicate this.

Should data surpass expectations and indicate a resilient US economy, the US Dollar could strengthen. The upcoming official employment data on Friday, along with any remarks from Federal Open Market Committee members, will be closely watched. Furthermore, the Fed Chairman’s informal engagement with journalists later today will draw attention, especially regarding insights into the regulator’s future actions.

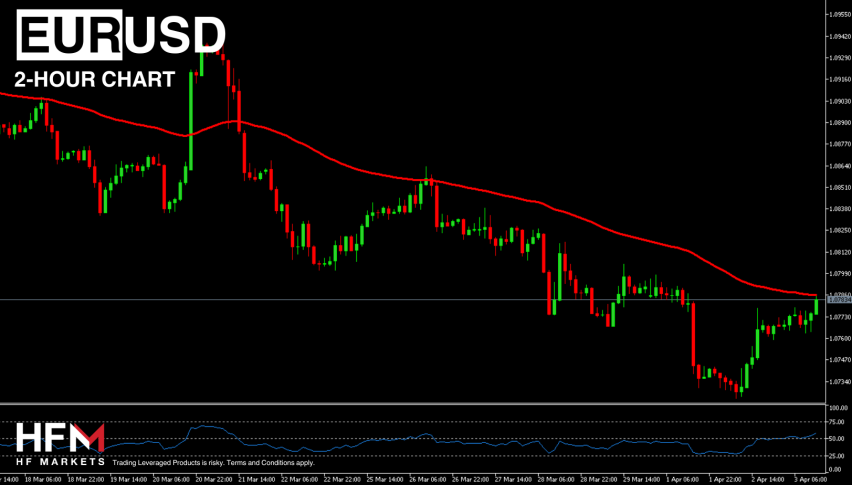

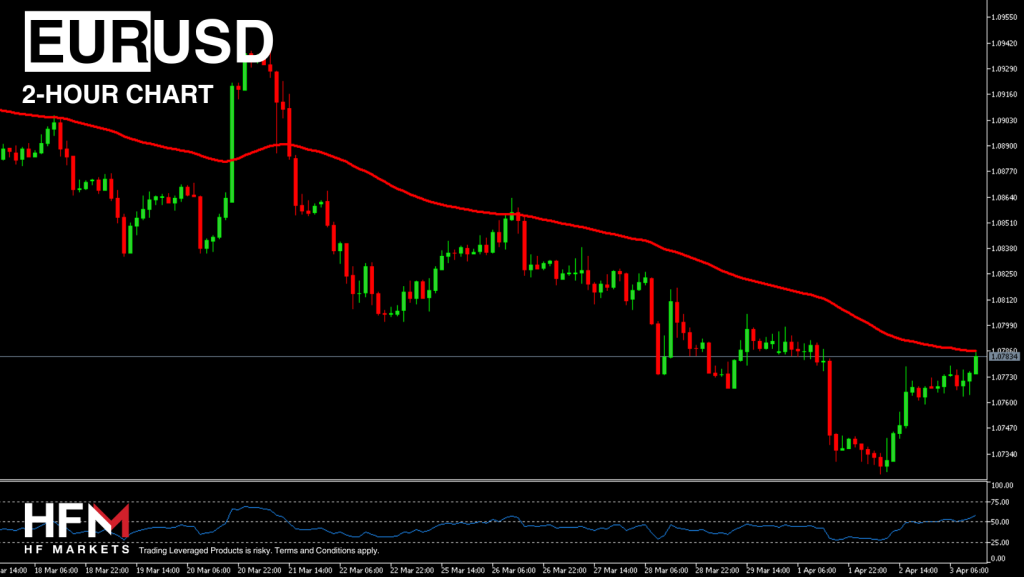

Examining longer-term timeframes, such as the popular 2-hour chart, the EURUSD price trajectory continues to suggest a downward trend. Trading below the 75-bar EMA, price action consistently aligns with a bearish pattern. A breach below 1.07682 could trigger sell signals, signalling a looming downturn.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account