Remaining Bullish on EUR/GBP As EU Services Start to Expand Again

EUR/GBP has turned bullish this week as the Eurozone and German economy and particularly services give positive signals. This sector has been in recession since August last year. So, this is a positive development for the Euro, which is seeing some renewed demand, despite the ECB having already confirmed a June rate cut.

EUR/GBP Chat H1 – The 50 SMA Keeping the Trend Bullish

The EUR/GBP exchange rate has been trading in a narrow range, fluctuating within a 1-cent band between 0.65 and 0.66. This consolidation pattern has persisted as both the Bank of England (BOE) and the European Central Bank (ECB) exert influence on the currency pair. But, the recent data from the Eurozone and particularly Germany is giving some positive signals, which has been keeping this forex pair on a bullish trend this week. Now we are heading toward the top of the range, so we’ll see if buyers can push above 0.66.

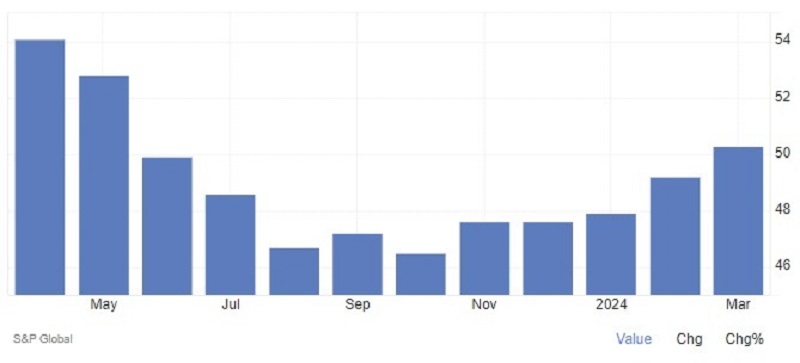

Final German and Eurozone Services and Composite Purchasing Managers’ Index (PMI) for March

- German final services PMI: 50.1, compared to the expected 49.8.

- Eurozone final services PMI: 51.5, higher than the anticipated 51.1.

- German final composite PMI: 47.7, exceeding the forecast of 47.4.

- Eurozone final composite PMI: 50.3, surpassing the expected 49.9.

The higher-than-expected readings for both German and Eurozone services PMI indicate stronger growth in the services sector. Additionally, the composite PMI readings for both Germany and the Eurozone show a slight expansion in economic activity after being in contraction for a long time, although the German composite PMI remains below the 50 threshold, which means still in contraction.

Comments on the data by S&P:

- Stabilization in the Services Sector: S&P notes a glimmer of hope in the German services sector as activity stabilized in March, marking the first time in six months. While challenges in acquiring new business persist, there are signs of a gradual easing in the downward trend. Despite this, it’s unlikely to prevent another quarter of declining GDP at the beginning of the year.

- Employment Trends: The labor shortage continues to prevent companies from laying off staff, resulting in a third consecutive month of employment growth, albeit with some moderation recently. Companies seem optimistic about future workloads justifying current staff expansion, reflecting a brightened future outlook among service providers.

- Cost and Pricing Pressures: Costs within the service sector are still rising, albeit at a slower pace compared to the previous month. This hints at a deceleration in wage growth momentum. Inflation in sales prices has also declined, indicating increased competitive pressure among service providers and a corresponding decrease in pricing power. This could alleviate concerns about inflation in the service sector for the European Central Bank. However, S&P suggests that this single monthly figure may not be sufficient to prompt a loosening of monetary policy in April.

EUR/GBP Live Chart

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |