Tesla’s Q1 2025 Earnings Report: A Comprehensive Analysis

In the dynamic landscape of electric vehicle (EV) manufacturers, Tesla, Inc. stands as a prominent player, known for its innovation and market influence. However, recent developments have brought challenges to the forefront, impacting its position in both domestic and international markets. As Tesla prepares to unveil its Q1 2024 earnings report, scrutiny intensifies amidst a backdrop of shifting market dynamics.

Tesla’s Performance in Q1 2024:

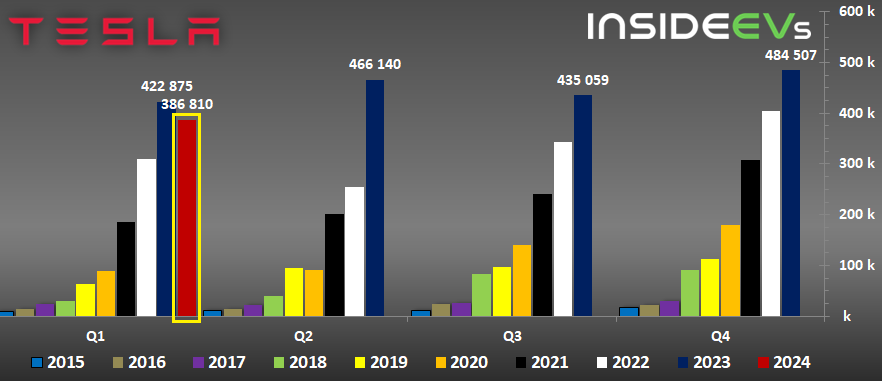

Tesla’s Q1 2024 production and delivery figures depict a nuanced narrative. While total vehicle production experienced a modest decline of -1.69% compared to the previous year, total deliveries witnessed a more pronounced downturn, plummeting over -8.5%. Notably, this marks the first decline in deliveries since the onset of the global pandemic in 2020, underscoring unexpected challenges faced by the company.

Factors Contributing to Decline: Several factors contributed to Tesla’s subdued performance in Q1 2024. Issues such as production ramp-ups for the updated Model 3, disruptions caused by geopolitical tensions, and an arson attack at Gigafactory Berlin compounded challenges, resulting in a decrease in production and deliveries.

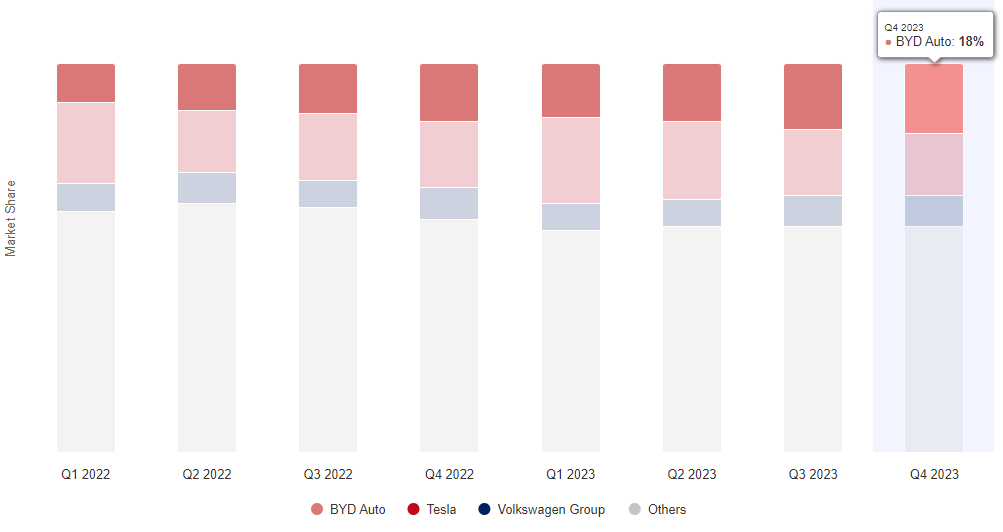

Global Market Dynamics: The global EV market landscape witnessed significant shifts, with Tesla facing intensified competition, particularly from Chinese automaker BYD. BYD’s strategic focus on affordability and market expansion, coupled with its diverse product offerings, poses a formidable challenge to Tesla’s dominance. Moreover, the emergence of new entrants like Xiaomi further complicates Tesla’s competitive landscape.

Financial Overview:

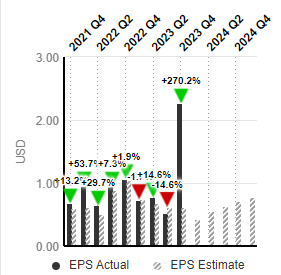

Despite revenue growth in Q1 2024, Tesla’s operating income experienced a notable decline, attributed to factors such as reduced vehicle sales prices and increased operating expenses. Projections for the upcoming earnings report suggest a decline in sales revenue, operating profit, and net income, reflecting ongoing challenges faced by the company.

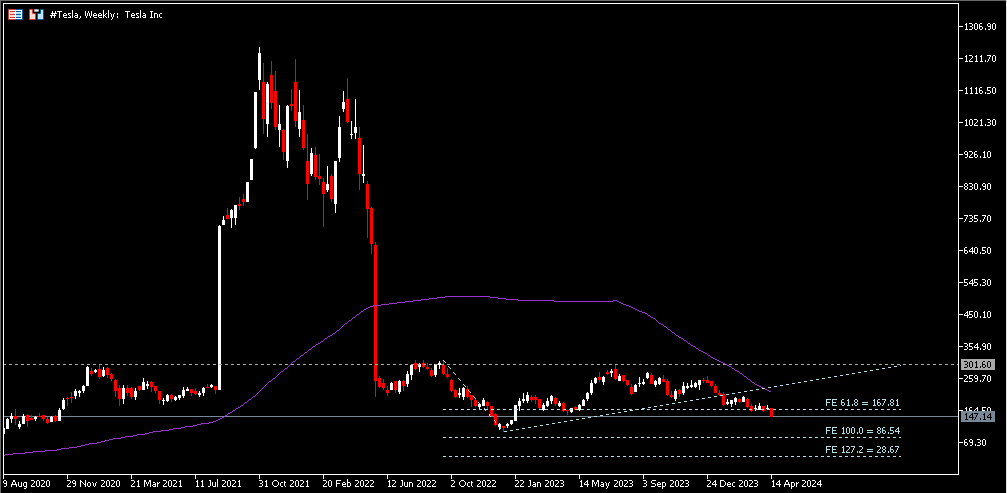

Market Analysis: Technical analysis of Tesla’s stock performance reveals a downward trend, with shares reaching a new low since late January 2023. Concerns surrounding sales numbers and demand fluctuations have contributed to YTD losses exceeding 40%. Moving forward, resistance levels and support thresholds will influence the trajectory of the stock amidst evolving market conditions.

As Tesla prepares to disclose its Q1 2024 earnings, stakeholders eagerly await insights into the company’s performance and strategies to navigate prevailing challenges. With competition intensifying and market dynamics evolving, Tesla faces a pivotal juncture in its journey towards sustainable growth and market leadership in the dynamic EV industry.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account