Unveiling Apple Inc.’s Q2 2025 Financial Performance: Insights, Challenges, and Market Outlook

Apple Inc., the iconic multinational technology titan renowned for its cutting-edge products, is poised to disclose its earnings report for the Q2 of 2024 on May 2nd. This highly anticipated event offers investors and industry enthusiasts alike a comprehensive overview of Apple’s financial health, growth trajectory, and future prospects.

Market Dominance and Market Capitalization

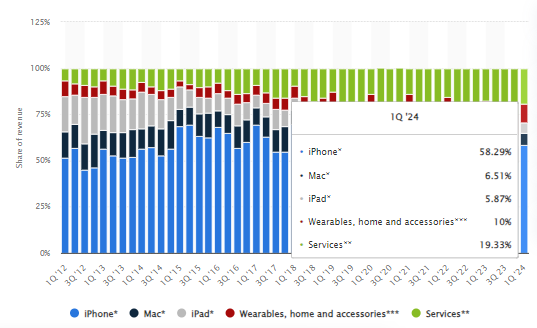

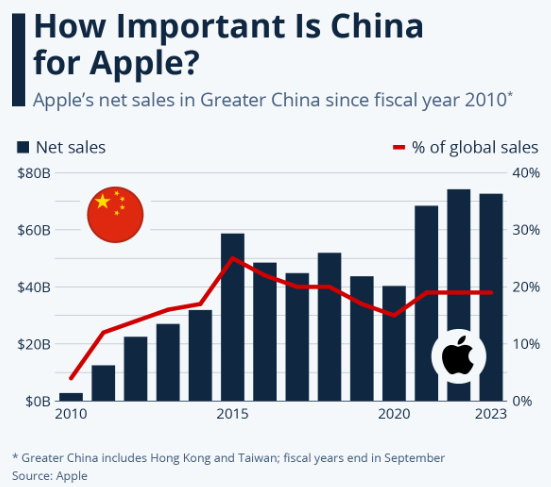

With a market capitalization exceeding $2.6 trillion, Apple remains a dominant force in the industry. However, its revenue heavily relies on hardware sales, constituting nearly 81% of total revenue last quarter. While iPhone sales saw growth, there was a slight dip in smartphone shipments, especially in China, due to increased competition and economic challenges.

Revenue Breakdown: Hardware Dominance and Services Surge

Apple’s revenue reflects a strong reliance on hardware sales, which accounted for 81% of its total revenue in the previous quarter. Despite this, the services segment has experienced a notable surge, reaching record highs in revenue. The iPhone remains a key revenue driver, with sales revenue witnessing a promising increase. Recent reports indicate a decline in smartphone shipments in critical markets like China, attributed to intensified competition and economic challenges.

Challenges on the Horizon: Regulatory Scrutiny and Competitive Landscape

Apple faces an array of challenges as it navigates a dynamic and competitive landscape. Regulatory scrutiny, evolving consumer sentiments, and emerging technological trends pose significant hurdles for the company. While Apple is poised to introduce AI features in its upcoming iOS 18, it trails behind competitors. Competitors already integrated such functionalities into their devices, highlighting the need for innovation.

Sales Performance and Market Projections

Apple’s Mac division maintained stability, while the iPad and wearables experienced a decline, partly attributable to a lack of innovation and ongoing patent disputes. Analysts project a decline in sales revenue for the upcoming quarter, reflecting a cautious outlook amid prevailing market conditions. Operating profit and net income are also anticipated to decrease compared to the previous quarter, underscoring the challenges facing the company as it seeks to navigate an increasingly complex and competitive landscape.

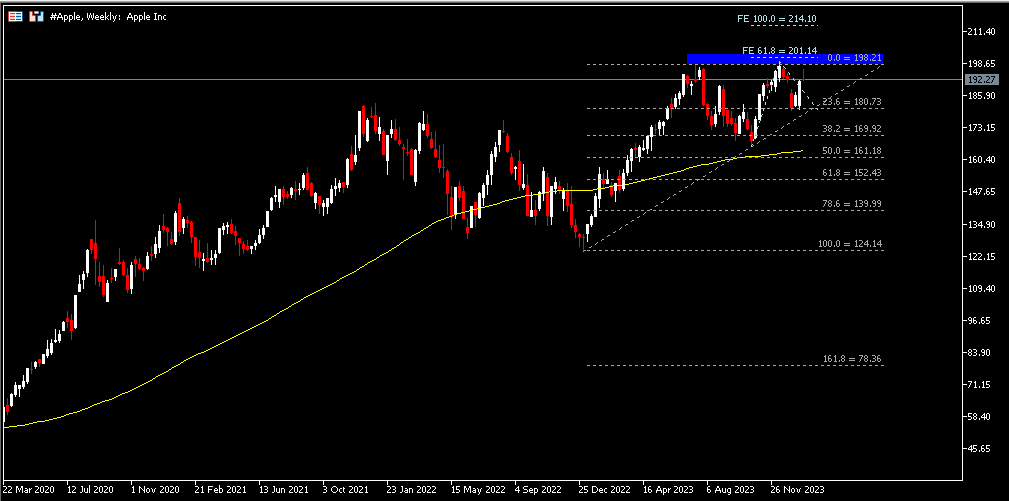

Technical Analysis and Market Outlook

From a technical perspective, Apple’s share price has exhibited a mixed outlook, with indicators suggesting a bearish trend. However, market sentiment remains uncertain pending the release of the earnings report. A positive earnings outcome could serve as a catalyst for renewed investor confidence and potentially drive the stock price higher. Conversely, failure to meet expectations may exert downward pressure on the stock.

As Apple is ready to unveil its Q2 earnings, stakeholders are bracing for shifts in market dynamics and insights into the company’s future. The financial results offers an assessment of Apple’s performance, strategic direction, and resilience in the face of evolving challenges. Stay tuned for the updates on Apple’s outlook as the company continues to shape the future of technology and innovation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account