Asian Stock Market Showed Gains As Fed Kept Current Interest Rates

Asian stocks and US futures saw gains following the Federal Reserve’s interest rate hike concerns

In today’s trading session, Asian stocks and US futures saw gains following the Federal Reserve’s interest rate hike concerns, while the Japanese yen experienced volatility amidst a report of potential intervention from Japan.

The Japanese Yen spiked as much as 2% fueled by rumors of renewed intervention by Japanese officials to purchase yen, along with a weak US dollar after the Fed meeting. However, the yen later retraced its gains, undoing its earlier surge. The dollar was trading at 155.31 yen, a sight increase from 154.91 yen.

According to Stephen Innes, managing partner at SPI Asset Management, Japan’s Ministry of Finance, via the Bank of Japan, resumed its sales of US dollars to maintain stability in the yen as expected. In fact, the Japanese government is tapping into its massive 1.2 trillion USD reserve, aiming to capitalize on the dollar holdings acquired back in 2000. Innes also stated that the objective was to stabilize the yen within the range of 155-157 against the dollar.

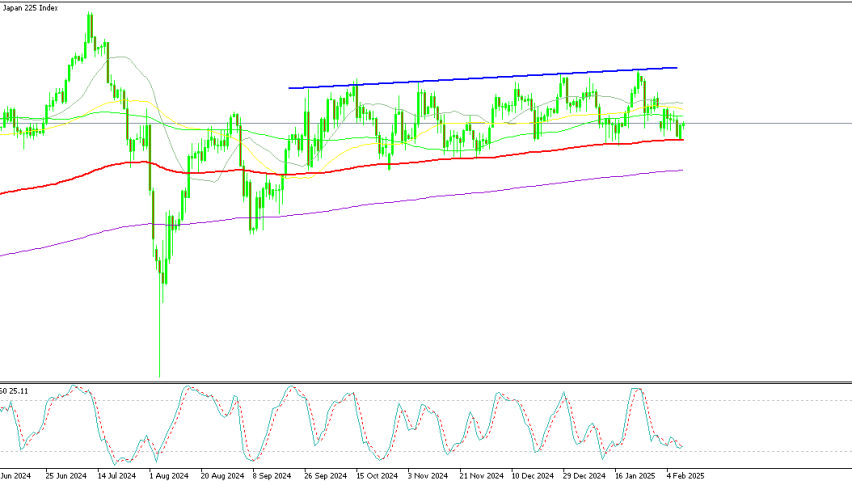

Tokyo’s Nikkei 225 index went down by 0.1% to 38,236.07.

Losses remained relatively contained as investors refrained from making significant moves ahead of an extended holiday weekend in the market.

In South Korea, the Kospi declined by 0.2% to 2,686.30 following official reports indicating that the country’s consumer prices in April rose by 2.9% year-on-year, marking a declaration compared to March’s figures.

The Hang Seng index in Hong Kong surged by 2.4% to reach 18,190.32. Meanwhile, other markets in China remained shuttered for the Labor Day holiday.

In Australia, the S&P/ASX 200 went up by 0.2% to 7,587.00.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account