USD/MXN: Mexican Peso Strengthens After the Fed Kept Rates on Hold as Expected Yesterday

The Mexican peso gained 0.40% today as the Fed post FOMC conference gave the market the perception that the central bank is still on track to cutting rates this year.

The Mexican peso gained 0.40% today as the Fed post FOMC conference gave the market the perception that the central bank is still on track to cutting rates this year.

The US dollar’s immediate reaction to the Fed’s interest rate decision and post meeting conference was to drop against most currencies. While treasury yields also declined and continued to do so today, putting pressure on the dollar.

The market perception is that the Fed is still on track to cutting rates this year. September being the month showing the highest probability of the long-awaited Fed pivot. Yields for 2-year Treasuries are down 1.51% and 10-year Treasuries are down 1.23% on the day.

While the DXY has lost 0.21% since yesterday, the greenback has also been suffering against most emerging market currencies. For the Mexican peso the rise against the US dollar has been less pronounced.

Banxico will have their scheduled monetary policy meeting on May 9, and there may be some hesitation. Nevertheless, most forecasts are for the central bank to leave rates on hold at 11%. The gap in interest rates favors the Mexican peso in carry trades, and the expectations for US rates makes holding Mexican pesos even more attractive.

Technical View

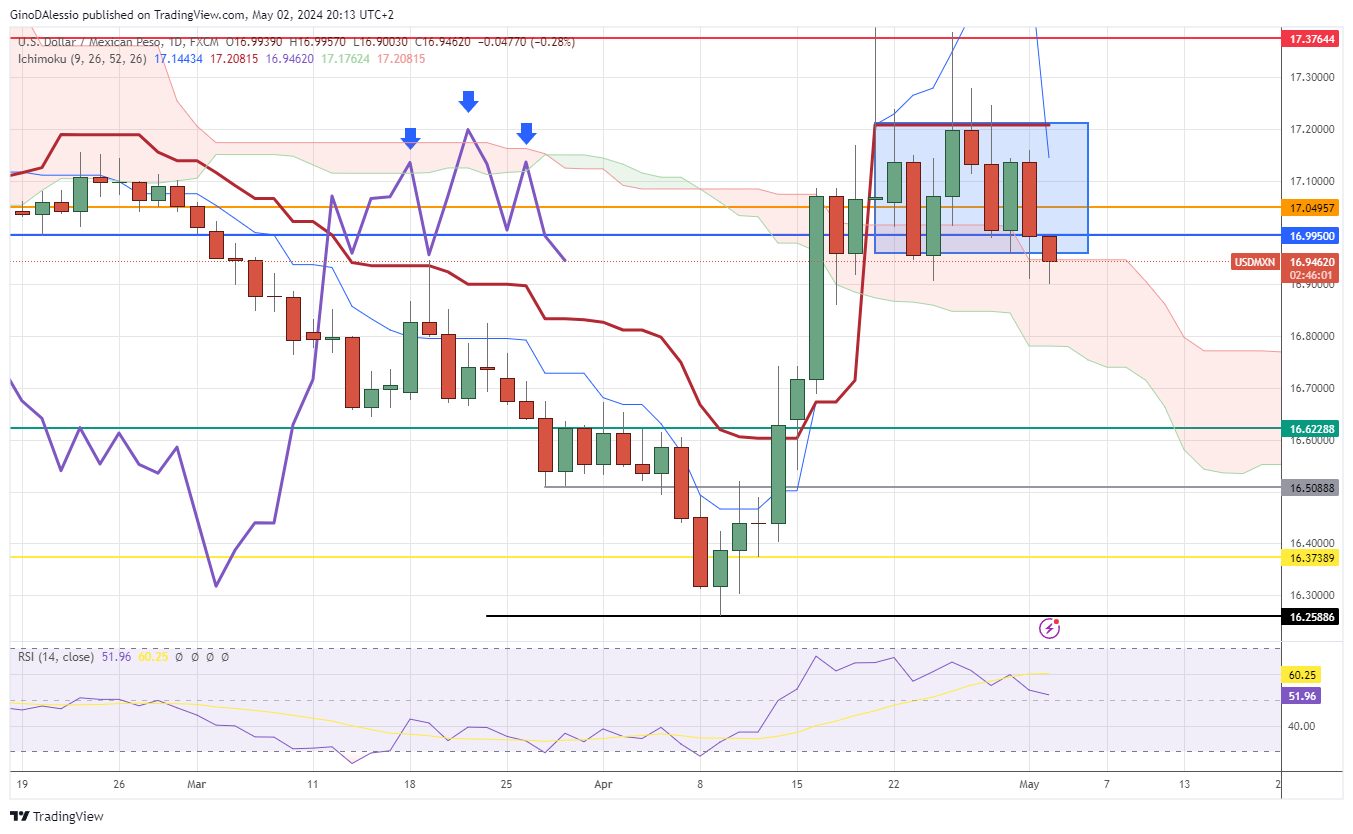

The day chart for USD/MXN below shows the market attempted to break above the Ichimoku cloud. The attempt lasted several days and created a congestion area (blue rectangle). A break to the downside of this area signals a possible renewal of the bear trend for this pair.

The Ichimoku system also shows a lagging line (purple line) that made a Head-and-Shoulders pattern as the market attempted to rise above the cloud. As with chart patterns this is also a bearish signal when produced by the lagging line.

We can also see how in its attempt to break above the cloud, the market met with resistance from the Kijun sen (crimson line). On all occasions the market failed to close above that line, which I read as a weak bullish market.

We still have to wait for today’s close, however, I believe a close below the blue area will lead to further declines in the USD/MXN pair.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account