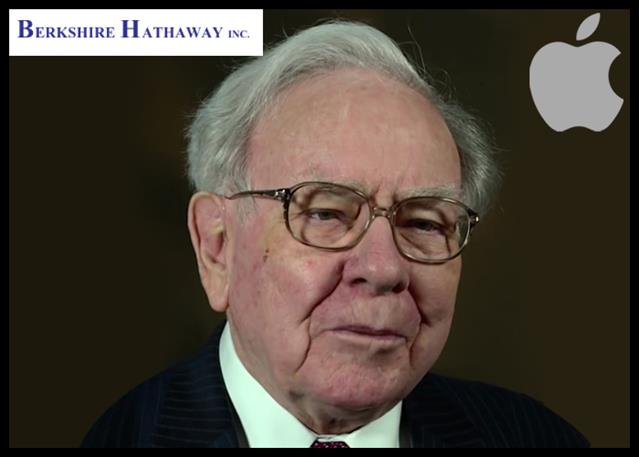

Warren Buffett's Berkshire Hathaway Cuts Stake In Apple

Warren Buffett's Berkshire Hathaway has trimmed a portion of its significant stake in tech giant Apple Inc., reportedly citing tax reasons. As per its first-quarter earnings report released over the ...

Warren Buffett’s Berkshire Hathaway has trimmed a portion of its significant stake in tech giant Apple Inc., reportedly citing tax reasons.

As per its first-quarter earnings report released over the weekend, Hathaway’s Apple stock was worth $135.4 billion as of March 31, 2024. This is lower than the $174.3 billion worth Apple stock as of December 31, 2023.

During Berkshire Hathaway’s annual shareholder meeting on Saturday, Buffett stated that the sale was for tax reasons following significant gains.

Meanwhile, Buffett at the meeting added that it was extremely likely that the iPhone maker will remain Berkshire’s largest holding at the end of 2024. Berkshire remains as Apple’s largest shareholder outside of exchange-traded fund providers.

Buffett reportedly had called the tech major his second-most important business after Berkshire.

In the preceding fourth quarter, the Omaha-based conglomerate had reduced its stake in Apple by about 10 million Apple shares, representing about 1 percent of its stake.

Last week, Apple had announced that its board had authorized $110 billion in share repurchases, the largest in company history.

In early May, Apple had reported weak earnings for its second quarter with lower revenue, but above market estimates.

Apple’s bottom line totaled $23.64 billion or $1.53 per share, compared to $24.16 billion or $1.52 per share a year ago. Analysts on average had expected the company to earn $1.50 per share, according to figures compiled by Thomson Reuters. Analysts’ estimates typically exclude special items.

The company’s revenue for the quarter fell 4.3 percent to $90.75 billion from $94.84 billion last year.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account