Bitcoin Exchange Inflows Hit Record Low: Scarcest Levels Since 2015

Recent on-chain data reveals a significant downturn in Bitcoin exchange inflows, marking the lowest levels observed since 2015. This trend s

Recent on-chain data reveals a significant downturn in Bitcoin exchange inflows, marking the lowest levels observed since 2015. This trend suggests a potential decrease in selling pressure and could be viewed as a bullish signal for Bitcoin.

As exchanges witness fewer deposits, the supply shock indicates that fewer holders are inclined to sell, possibly leading to tighter supply and upward pressure on prices.

This observation aligns with the current financial landscape, where traditional roles of exchanges are evolving, with alternatives such as spot exchange-traded funds (ETFs) altering investment dynamics in the cryptocurrency space.

Bitcoin Exchange Inflows Plunge to Decade Low: What It Means for Market Stability

Recent data shows a noticeable decline in Bitcoin exchange inflows, marking the lowest levels since 2015 and raising questions about the potential implications for the cryptocurrency market. Exchange inflows, which monitor the volume of Bitcoin deposited into exchange wallets, are a key indicator of market sentiment.

High inflows often suggest that investors are preparing to sell, possibly leading to bearish market conditions. However, the current low levels imply limited selling intent, which could stabilize or increase Bitcoin prices due to reduced supply pressure.

Key Insights:

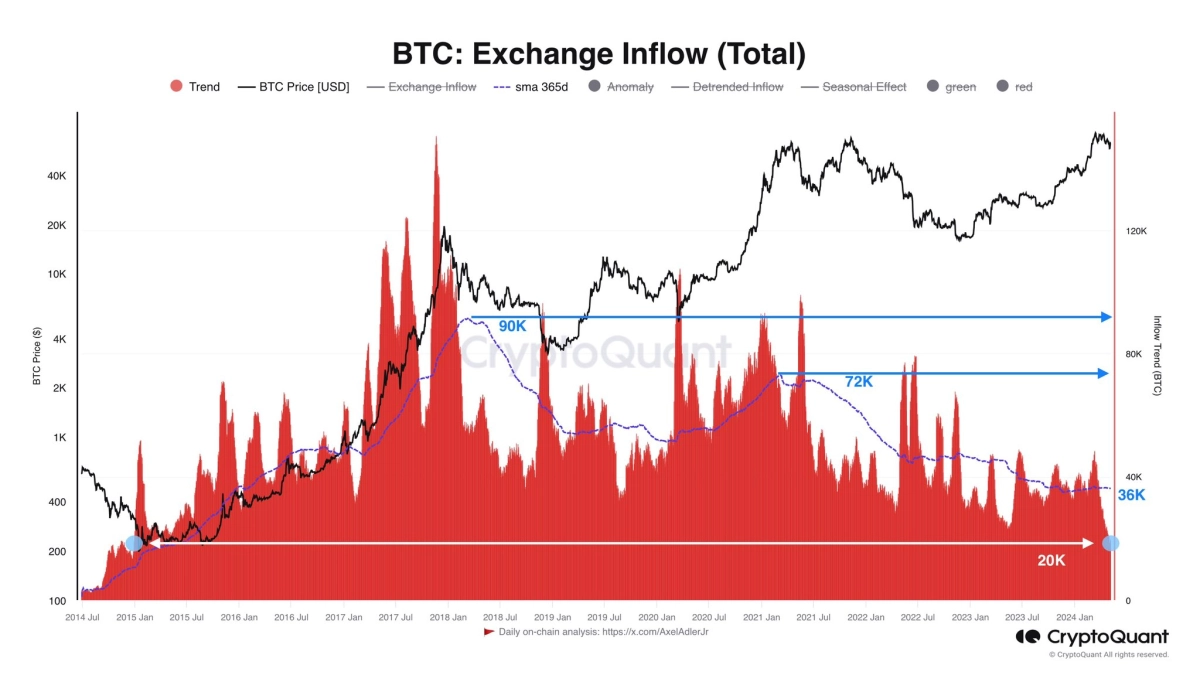

- Current Bitcoin exchange inflows are at 20,000 BTC, the lowest since 2015.

- The 365-day moving average for inflows has declined steadily from 90,000 BTC in 2018 to 36,000 BTC.

- Shifts in investment practices, such as the rise of Bitcoin ETFs, may explain the reduced reliance on traditional exchanges.

The declining trend in exchange inflows aligns with broader shifts in the cryptocurrency investment landscape. Previously, during the 2017 bull run, exchanges played a pivotal role in the market’s dynamics. In contrast, the 2021 cycle saw the emergence of alternative investment methods like Bitcoin ETFs, reducing the traditional dependency on exchanges.

This evolution continues today, with spot ETFs gaining popularity and diverting investor attention from exchanges, likely contributing to lower inflow figures. This ongoing change suggests a maturation of the market, where Bitcoin’s investment infrastructure evolves beyond traditional exchanges.

If the trend of low inflows persists, it could signify a foundational shift in how Bitcoin is held and traded, potentially leading to a more stable and less volatile market environment. Having that said, Bitcoin briefly rose above $65,000 before falling back to $63,100.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account